Chief Conclusion

A month ago, we explained George Soros’ “reflexivity” to help explain why we thought more weakness lay ahead for many emerging markets. Since then Argentina’s currency has collapsed further, falling another 25% in just a week. Many are suggesting that the bottom may be in. What happens now? Today we examine the silver/gold ratio, a useful indicator of liquidity, whose downtrend suggests to us that continued short term caution is prudent.

A month ago in our note on reflexivity we said:

Investors should regard with caution any attempt by consensus, blind to reflexivity, to blithely dismiss the potential severity of unfolding emerging market weakness. After the crisis has passed, long term investors may prudently expect to find extraordinary values once these forces are spent.

I have learned to never say never when it comes to financial markets. Still, though, I think it came as quite a shock to many investors to see Argentina’s currency collapse by 25% in a single week. Even by financial market standards, that was a huge move. With prices in that market now markedly lower, is now the time to buy? We believe that this “unexpected” move is just the latest example of the merit in understanding Soros’ principle of reflexivity. You can learn more about this principle in “Alchemy of Finance.”

As value investors, we savor a good panic-driven selloff as much as anyone. We understand that situations filled with uncertainty may be compelling potential long-term investments. The reason is simple: panic surrounding a lower entry price often brings with it a compelling valuation, which offers downside protection while patiently waiting for longer term upside. But if we have learned anything in the last twenty years, it’s to be mindful of trends in liquidity when examining sell-offs. Liquidity trends are especially important when evaluating the investment merits of reflexive assets, such as emerging markets.

“I got this feeling that its later than it seems" - Jackson Brown

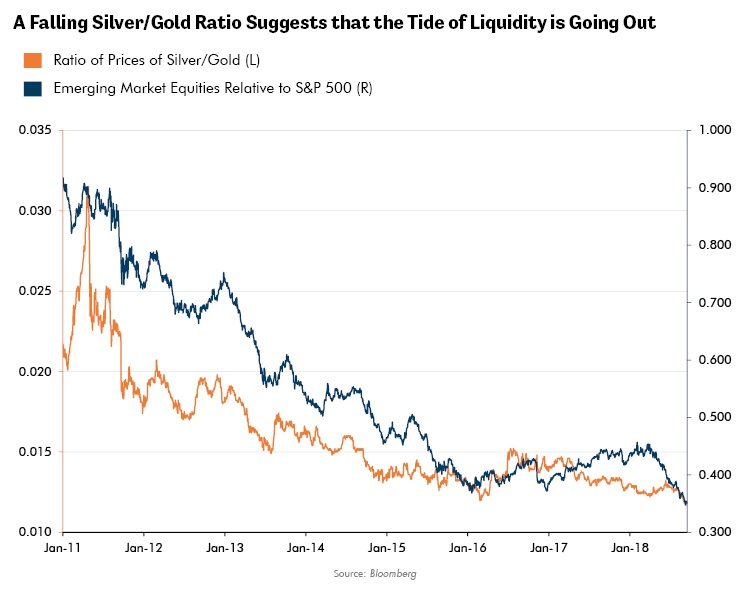

Sadly, unlike the gas gauge in your car’s dashboard, the market lacks an explicit gauge that can blink at you when the fuel of liquidity is running low. We believe that there is, however, a rough yet still useful handy proxy for liquidity – the silver/gold ratio. Our experience is that this ratio provides worthwhile insight into whether the tide of liquidity is coming in or going out. Today we examine this ratio. It appears to suggest that, for now at least, the tide is going out.

We highlight in the chart above the relative performance of emerging market equities relative to the S&P 500 alongside the silver/gold ratio. The point we would like to illustrate is that emerging markets, as Soros’ reflexivity suggests, are sensitive to trends in liquidity. Per the above chart, both remain in a down trend, and both have hit new lows for the cycle.

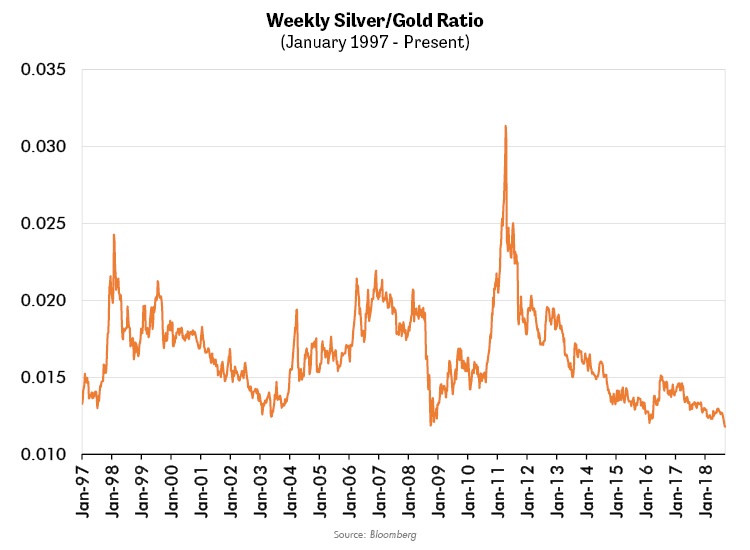

Our experience has been the silver/gold ratio is one of the most sensitive leading indicators of liquidity. We believe that a fundamental reality lies behind this relationship. Both gold and silver are precious metals. The nature of the supply and demand for these metals, however, varies. Our experience is that silver is the more sensitive of the two to incremental changes in liquidity and/or inflationary expectations. My experience in real-time watching the silver/gold ratio move from its lows was helpful in both 2003 and again in 2008. In 2003, its rise indicated that the long bruising decline in emerging markets was finally over. Again in 2008, while the world was crashing, the silver/gold ratio demonstrated its insight by turning up in late 2008. I believe this ratio can be equally insightful when booms turn into busts, as this indicator amply displayed in mid-2008 and again in 2011.

We are now nearing historic lows in this ratio. This may suggest that we are in the zone during which we may reasonably expect that values in many emerging market investments will become compelling. Our discipline, however, learned through many trading cycles, is to pair our valuation-driven insights with an informed view on liquidity. It is our expectation that a sustained turn in the silver/gold ratio may very well be the final link that turns us into more aggressive buyers of the select investments that our research team has identified among this challenged asset class.

In Conclusion

There are many different tools that have proven their merit to us in the last twenty years. Valuation is at the heart of everything we do. However, we do not make investment decisions in a vacuum. We have learned how impactful it can be to heed the insight of certain indicators, especially when judging the merits of more volatile and liquidity driven asset classes such as emerging markets. We believe that the combination of the above, plus a healthy respect for reflexivity, has helped us to navigate the challenges through which many emerging markets are now suffering.

“Only when the tide goes out do you discover who’s been swimming naked." - Warren Buffett

The lightning quick reversals in many of the once-booming emerging market indices suggest that these insights can be valuable. Many investors discovered too late that, once the rising tide of liquidity turned and went out, they were in fact “swimming naked.”

The lesson I take from this? If you want to avoid your portfolio getting swept out with the tide, you should be prepared to sell early. Bernard Baruch once said that he was rich because he always “sold too soon!” One tool that can help you “sell too soon" is the silver/gold ratio. In our experience, it’s one of the most insightful liquidity indicators. Its message remains a cautionary one for emerging markets.