CHIEF CONCLUSION

Charlie Munger, Warren Buffett’s business partner at Berkshire Hathaway, argues that one of the world’s most powerful forces is that of incentives. I think he is right. Today I want to talk about how our policy makers are trying to change incentives, and how these changes might end up leading to very different outcomes than the ones our policy makers are hoping for. While these are shaping up to be challenging times for investors, we think that both our internal investment research and our estate and tax planning expertise have never been more valuable tools to help our clients navigate a changing world.

“Show me the incentives and I will show you the outcome.” – Charlie Munger

The Cobra Effect

The British Raj, or rule of India, lasted for almost a hundred years, ending in 1947. During this time, India’s British rulers became concerned by the proliferation of venomous cobras in their lands and pondered the best way to rid themselves of this feared killer – the largest of which can measure 18 feet in length. A cobra’s poison can kill in less than thirty minutes, so their concern was understandable. To beat back this foe, the British administrators conceived a simple plan: pay out a monetary reward for each dead cobra. For a while, that worked – or so it seemed.

The British Raj, or rule of India, lasted for almost a hundred years, ending in 1947. During this time, India’s British rulers became concerned by the proliferation of venomous cobras in their lands and pondered the best way to rid themselves of this feared killer – the largest of which can measure 18 feet in length. A cobra’s poison can kill in less than thirty minutes, so their concern was understandable. To beat back this foe, the British administrators conceived a simple plan: pay out a monetary reward for each dead cobra. For a while, that worked – or so it seemed.

Then the British administrators discovered to their surprise that their seeming “progress” was an illusion. The profits from selling cobras to the government had brought forth a cobra-breeding industry which supplied young cobras to enterprising growers, who in turn nurtured and then sold them to the British authorities. The unintended consequence of the British policy to eliminate cobras was to bring forth more cobras. The British, to their credit, once they discovered their error shut down the perverse incentive that they had unwittingly created. Of course, this too had an unfortunate and unexpected impact as the loss of future revenue led the cobra-breeders to release their snakes into the wild, making the existing problem even worse than it was to start!

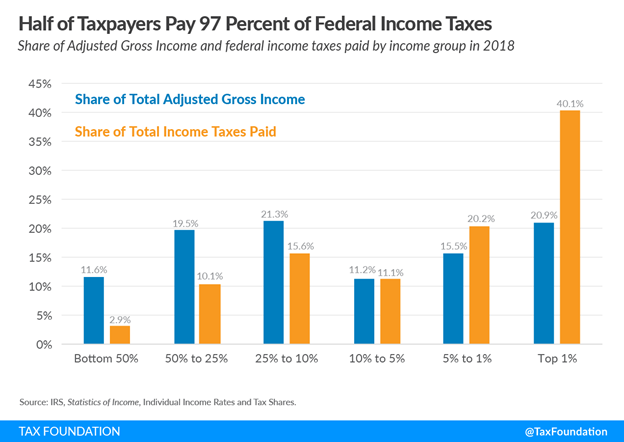

There is a profound lesson in this: how important incentives are to the efficient functioning of the economic world. An economy is a fine balancing between many actors, such as wealthy taxpayers and the government that taxes them and spends their money. The chart below from the Tax Foundation illustrates with data from 2018 that in the United States, only half of all taxpayers pay 97% of federal income taxes and that the top 1% pay an astonishing 40%! While that might sound like a lot to you, our policy makers seemingly have even bigger plans for the wealthy in our economy to “pay their fair share.”

“You never want a crisis to go to waste. And what I mean by that is an opportunity to do things that you could not do before.” – Rahm Emanuel (Chief of Staff to the Obama Administration from 2009 to 2010).

I think we can all agree that the COVID-19 pandemic was a crisis. Our elected officials are taking Mr. Emanuel’s advice and making good use of it to do things never done before, such as incredible peace-time deficit spending by the government. The new priorities for this spending, as I understand them, are addressing wealth inequality, climate change, and social justice. The dollars are huge. The policy approach is also novel, as the government seems committed to making this happen with some combination of government spending and cooperation from the Federal Reserve, our central bank which is helping to facilitate this with aggressive purchasing of government bonds. This is new in terms of both size and scope.

A War on Wealth?

Our publication first highlighted our concern in February of 2019 about the growing trend of wealth re-distribution. Then, the catalyst was the released platforms of the candidates for the 2020 Presidential election and their views on taxation. Now, with a new Administration in office, we are getting a clearer look at the policy direction it is choosing for our country. A bigger role for government demands more resources, and much higher government deficits in our new post-COVID-19 world. Our country is not alone in this trend.

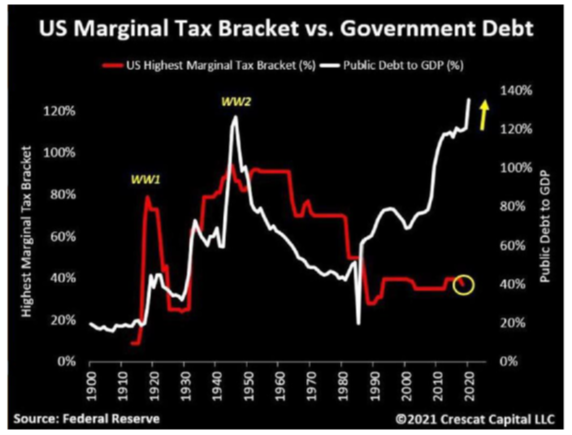

As the chart below demonstrates, historically there has been a close relationship between the highest marginal income tax rates for U.S. wages and the government’s public debt to GDP ratio. I believe that this relationship is now reasserting itself with a lag: policy makers seem serious about raising taxes.

I believe that taxes are heading higher for a long period of time, as policy makers seek out a more vigorous role for government and the historic relationship above reasserts itself. Certainly, it makes sense to me that if the government is going to “do more” by spending more, that money will come from somewhere, such as the trend of higher taxes shown above. I have found cold comfort in the promises of the poorly named “Modern Monetary Theory” or “MMT”, which is sometimes derisively referred to by its critics as “Magic Money Tree.” This school of thought says that our government can create the money it needs out of thin air to fund all of its ambitious goals.

Furthermore, the theory says that if the government were to somehow make a mistake and create too much money and thus too much inflation – then the government will just raise taxes to withdraw the excess. So, higher taxes on the wealthy for multiple reasons – especially if inflation gets out of hand!? Am I the only one that thinks this is a problem? Are our policy makers really saying that they can raise taxes and there will be no change in behavior or other unintended consequences? Is no one paying attention to the recent sustained exodus of high-income earners from high tax jurisdictions to low tax jurisdictions, such as our own sunny Florida? These people, at least, are voting with their feet. Did our policy makers see that coming? Is this another unintended consequence? What other surprises will such an expanded role for the government hold?

My belief is that the markets are the greatest problem-solving tool man ever created. Markets – if they are allowed to function that is – move prices up and down to create incentives to supply the demands of the economy. Economies with the world’s worst records of growth have shunned the discipline of the market – ignoring its ability to set prices and drive incentives to balance supply and demand. Among the most obvious examples, which I wrote about last month included Cuba, North Korea, and the Soviet Union. My greatest fear as I survey our future, is the outline of the end of the Supply-Side Revolution coming into view; the self-reinforcing trends of 1.) deregulation, 2.) falling taxes, and 3.) limited government. Those trends kicked off in earnest in the late 1970s in response to the obviously dismal 1970s era of low real growth and high inflation. I believe that the world’s adoption of these policies was the biggest factor behind the global boom in wealth creation over the past several decades. But what happens now? After all, the markets are forward-looking, so what matters most is the future not the past.

“One of the great mistakes is to judge policies and programs by their intentions rather than their results.” – Milton Friedman

Every day I see more regulation, rising taxes and rising government meddling in the economy. I do not doubt that its well-intentioned, but as Milton Friedman notes, what is more important is will it work? I personally have my doubts.

If the prior Supply-Side Revolution ran for nearly 40 years before seemingly exhausting itself, how long might this new trend run? Surely, I think it is no exaggeration to say it too could run a full generation or longer. At important cyclical trend changes, which I believe is where we find ourselves right now in the cycle from wealth creation to a new cycle of wealth re-distribution, the most important thing is to keep an open mind to change. That is the best way, in my opinion, to profit from the change, rather than be hurt by it.

It should be noted that the prior cycle of wealth creation began in the late 1970s after some major and sustained policy mistakes, with accordingly some of the cheapest equity valuations in history and some of the highest bond yields in history. This cycle of wealth re-distribution is beginning with the lowest bond yields ever and equity valuations matching all-time highs. This is one key reason, as we explained in our most recent “Market Happy Hour,” that our goal is to create portfolios that look meaningfully different from “the market.” I believe that, if outperformance is the goal, the best investments to own may well look very different from those that worked in the past, in the old “pre-COVID” world. That is how our research team sees it, anyway, and is investing accordingly.

“Nothing is certain but death and taxes.” – Benjamin Franklin

Few would doubt the judgment of the wise Ben Franklin on the topic above, but there is a way we believe our firm can help. I would not be doing my job if I neglected to mention the estate planning and tax capabilities of our firm. My partner Bill Beynon, our firm’s President and CEO, who has more than twenty-five years’ experience in financial planning, has told me that the potential tax changes underway now are the largest he has seen in his career. While many potential tax and estate planning issues are yet to be finalized, Bill believes that now is the time to thoughtfully examine the most tax-efficient choices that the law makes available for families seeking to protect their wealth for future generations.

In Conclusion

In my opinion, the market is the most powerful tool man ever created. The more we interfere with the market’s allocation of resources and tinker with its incentives, the worse the market will work, which means specifically that it will do a poorer job balancing supply with demand. My fear is that our well-intended policy makers and thought leaders may suffer the fate of the Cobra Effect and discover unintended consequences from their well-meant goals for bigger government. Now, more than ever, we believe that our internal investment research team and estate and tax planning effort can help our clients navigate an uncertain future. Let us know how we can help!