One of the most important achievements of highly successful investors is to identify and understand - early on – a trend that becomes a dominant investment theme. Many professionals will spend their entire careers in the pursuit of this exceptionally elusive goal. The obstacles are daunting, but the rewards are tremendous.

Just think of it: there is so much in the world for investors to analyze. Stocks, bonds, commodities, more than a hundred different countries and currencies, and within each of these countries hundreds of sectors from healthcare to telecommunications and from chemicals to high technology. And, of course, within each of these sectors, there may be hundreds of companies. Seeking the dominant theme often feels like a search for the proverbial needle in a haystack.

Three examples help demonstrate the profits that may be earned - or losses saved - by those who get it right. Who could forget the legendary returns for the early investors in technology from the beginning 1990s into 2000? Or those earned by commodity and emerging market investors from 2003 to 2011? Or even investors who saw and understood the early drivers of the financial crisis that would unfold from 2007 to 2009? These were all dominant trends whose returns defined their day. The returns from these trends were the stuff of legend. Countless family dynasties were forged by getting such powerful moves right. Other fortunes were no doubt kept safe from the storm by heeding the signs of crises that others missed. So investors must ask themselves: are we analyzing the right themes and the right sectors? Do we need to be experts in what we analyze? Absolutely. That is necessary - but not sufficient. Investors have to be experts in what matters! As Napoleon so aptly puts it: ability is nothing without opportunity.

I was very fortunate to hit upon, at a very early stage, two of the three dominant themes outlined above. For more than a decade now I have been a daily student of the credit markets, working hard to understand how they work and the messages they have for the broader economy and markets. During the financial crisis, understanding credit was the difference between financial life and death. Credit is at the heart of our economy and of our markets.

It’s my belief that the world now finds itself secularly over-indebted. I am convinced that debt, and how we deal with it, is a dominant theme of our time. Today’s “Trends and Tail Risks” examines the unfolding trauma in the junk bond market and asks the question: what might the future hold for this and other markets?

U.S. Junk Bond Market in Freefall: A Mutual Fund Freezes Investor Redemptions

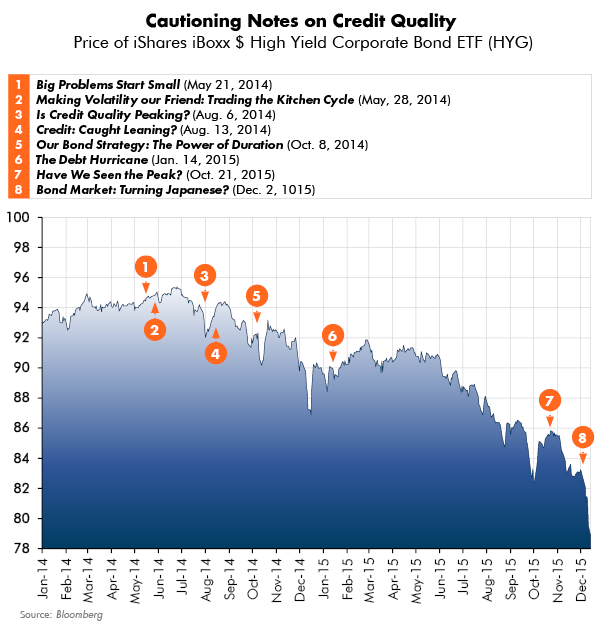

Last week’s financial headlines were dominated by the news of the freezing of investor redemptions from a mutual fund, the Focused Credit Fund managed by Third Avenue Management. The ongoing rout in junk bond prices has now claimed many victims. This publication has been warning of the unfolding risks to this sector for more than a full year now (Is Credit Quality Peaking?, August 6, 2014; Credit: Caught Leaning, August 13, 2014). Investors who owned these bonds through Third Avenue Management’s mutual fund have found themselves suffering from an even greater indignity than the losses that they have already suffered: they are now barred from access to their own money! This mutual fund seemingly offered its investors the promise of daily liquidity, yet owned illiquid assets. The market’s ongoing dislocation has sought out and found the logical inconsistency in how the fund was positioned. What other mistakes will the market reveal as junk bond weakness spreads further? How did this happen? What does all this mean for investors?

U.S. Junk Bond Market in Freefall: The Result of Decades of Fed “Rescues”

Prior publications (Bond Market: Turning Japanese, December 2, 2015) have examined U.S. Federal Reserve actions to “rescue” the economy and the unintended consequences of these policies. And remember that the Fed’s recent actions are only the latest in a long line of Fed “rescues.” The Fed lowered interest rates to rescue the markets from the forced liquidation that followed the crash of the Tech Bubble in 2000. Many investors’ thirst for higher yields created a flood of cheap credit that flowed into mortgage bonds and spawned a Housing Bubble by 2007. The Fed rescued the markets from the forced liquidation that followed the crash of the Housing Bubble in 2007 by lowering interest rates, again. See the pattern? Has another generation of investors’ thirst for higher yields created yet another Bubble? Is that what is deflating right now in emerging markets where yield-starved investors sought out higher yields? Is a similar meltdown underway now in the U.S. junk bond market?

The Age of Consequences

The common theme is that the Fed intervenes at a critical point during the market’s attempt to liquidate unsound debts. The Fed intervenes to stop the natural process of free market price discovery that clears the market at a price that matches supply with demand. Debt deflation, the process of debt reduction and deleveraging that used to coincide with recessions, has been strictly forbidden by our central banking leaders, and for good reason. Our debts, thanks to our central bankers, are now far too large for the previously palliative forces of debt reduction. Falling prices are now a threat. Let me explain.

High Leverage and Deflation Do Not Mix

Before the Great Depression the average U.S. bank was leveraged five times equity, meaning banks had assets that were five times larger than their equity. So a decline in asset prices of 20% would wipe out the banks’ equity. Now most banks in the U.S. own assets closer to 12-15x their equity. A decline in asset prices of only 6-8% is sufficient to eliminate their equity. If that sounds disturbing, you should look at Europe. It’s not unusual to see bank leverage twice or even three times as high! At an average leverage ratio of 50x, a 2% decline in asset prices would eliminate a bank’s equity. Leverage is even higher if one considers off balance sheet liabilities and derivatives that can be many times larger than on balance sheet liabilities.

This sky-high leverage is the imperative behind why our central banking central planners are desperate to take any steps necessary to support asset prices and to stop the forces of liquidation from lowering asset values. And don’t forget – in today’s world someone’s debt is someone else’s asset. The mortgage on your house, which is a debt to you, is an asset to the bank that owns that mortgage!

Investment Implications

The Fed has created – and seems committed to continuing – the secular growth of over-indebtedness. My framework suggests two investment implications: 1.) the continued fall of real interest rates for the highest quality debts, and 2.) periodic episodes where lower quality debts will trade at distressed prices. These two themes have dominated my writing on credit since 2014.

There are many ways that investors may profit from this secular trend. First, I have long advocated the purchase and patient holding of the longest duration and highest quality debt (Our Bond Strategy: The Power of Duration, October 8, 2014). Second, I have advocated gold as an investment that will profit during periods of very low and falling real interest rates (Gold: Price vs. Relative Value, July 23, 2014). Third, I have warned repeatedly that a slowing economy will further weaken credit quality and that lower-quality debts should be avoided, as the chart below demonstrates.

For now, I do not believe that the rewards of junk bond investing are compelling enough to merit an aggressive program of new investment. I continue to think that cautious investors can own a select handful of non-investment grade bonds with compelling, company-specific fundamentals. But the day is coming – as junk bond prices fall – when the rewards for investors will convincingly justify a much larger investment.

Jim Grant is right: there are no bad assets, just bad prices.

In late 2008, the crash in junk bond prices created a compelling investment opportunity. Their yields averaged north of 23%! When yields sank below 5% last summer, there was much more risk than reward in them. Yields are now approaching 9% as junk bond prices fall. Nine percent is better than five! This is better - but not yet compelling enough. Their day will come again as the cycle inevitably progresses. Until then, I am more than comfortable holding longer-duration, higher quality bonds. At the right time, the proper strategy will be to reverse this positioning and take profits from duration while embracing more credit risk. That day is coming but I do not believe that day is today.

Harnessing the Power of the Cycle: Owning the Right Investment at the Right Time

I have long been a proponent of opportunistic capital allocation. Doesn’t this make intuitive sense? Just as the changing seasons of the year require different clothing, the changing of the economic cycle also requires different portfolio positioning. The challenge, of course, is to reach the right conclusion on where one is in the cycle. Thankfully, the lessons of history offer insights willingly to those who, as I do, take the time to study them. For now this means that I remain concerned about the ongoing stress in the junk bond market and believe that a portfolio of high-quality dividend paying stocks, strong bonds, and special situations uncovered by our research team, is the optimal strategy. But a portfolio is a living thing that needs to adapt to its changing environment. I am committed to doing what it takes to match the ideal portfolio to its ideal environment.

The Secret to Highly Effective Fundamental Research

Napoleon, who famously noted that God fights on the side with best artillery, would also probably agree with the statement that God fights on the side of investors who do the best research! My research process focuses obsessively on three things. The first is the identification of those trends and tail risks that I believe can become dominant themes. To these topics and sectors I devote the lion’s share of my research. The second is the study of credit markets, and other important indicators, to inform my view of the optimal portfolio, tailored to where we are in the cycle. This defines which tool in the investment tool kit is the most appropriate at each point in time. The third is the identification of the right investments to own, at the right price, to best capture the upside I anticipate while limiting the risks that investments must overcome in order to reward their owners.

The changing phases of the cycle uncover new opportunities while depleting old ones. As long as there are cycles, this will never change! Investors who properly anticipate these changes can benefit from tailwinds while avoiding "unexpected" headwinds that may surprise others. As always, our challenge as investors is to focus our research on the right areas and to reach the right conclusions. No one said it would be easy! •