“Adam was but human — this explains it all. He did not want the apple for the apple's sake, he wanted it only because it was forbidden. The mistake was in not forbidding the serpent; then he would have eaten the serpent.”

“Adam was but human — this explains it all. He did not want the apple for the apple's sake, he wanted it only because it was forbidden. The mistake was in not forbidding the serpent; then he would have eaten the serpent.”

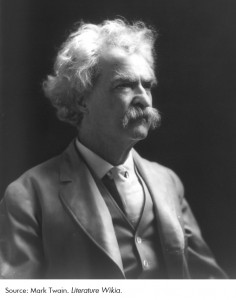

-Mark Twain, Pudd’nhead Wilson’s Calendar, 1894

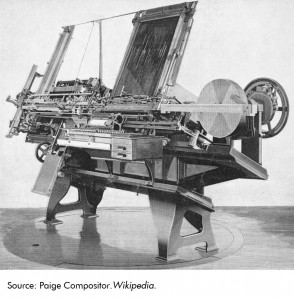

Mark Twain is one of my favorite authors. An amazing storyteller and craftsman of the English language, Twain just seemed to inspire more work out of his words than any other author. I believe his lesser-known short stories are actually among his finest (and funniest) works, such as “Cannibalism in the Cars,” “Journalism in Tennessee,” and “Hunting the Deceitful Turkey.” Twain was a true legend in his own time. This was a very good thing indeed because Twain was, sadly, a horrible investor. Among his many failed investments were a publishing company, numerous speculative mining ventures, and even a new kind of printing press, the Paige Compositor (see picture below), that he hoped would revolutionize the printing industry. The weight of these enormous losses forced him to keep working very late into his life.

It was from the months leading up to his personal bankruptcy in 1894 from which Twain reflected on Adam’s Original Sin: eating the Forbidden Fruit of the apple. Investing has its own original sin, which to me is reaching for yield, the practice of buying the bonds of weaker borrowers in the attempt to somehow snatch the tantalizing fruit of higher returns without suffering from the higher risk that accompanies weaker borrowers.

It was from the months leading up to his personal bankruptcy in 1894 from which Twain reflected on Adam’s Original Sin: eating the Forbidden Fruit of the apple. Investing has its own original sin, which to me is reaching for yield, the practice of buying the bonds of weaker borrowers in the attempt to somehow snatch the tantalizing fruit of higher returns without suffering from the higher risk that accompanies weaker borrowers.

Certainly Adam’s experience with the apple suggests that the outcome he achieved fell short of his expectations. So too, I fear, will it be with many investors in today’s high yield bond market. In this week’s Trends and Tail Risks we do a deep dive into the high yield indices. You just might be surprised at what you find in them – and in any high yield bond funds or ETFs that you may own.

The more deeply we examine the actual holdings of many high yield bond funds, the more troubled we become. Many investors who invest in bonds, particularly high yield bonds, do so through the structure of a mutual fund or perhaps an exchange traded fund (ETF). These instruments, of course, have their own additional set of fees that investors must pay. But that is not their only shortcoming. What exactly is in these funds? The answer is surprising, and disconcerting. This may not be a bad time to revisit long held, legacy high yield bond fund holdings retained because of imbedded capital gains. The only thing worse than selling at a profit and paying taxes is not selling and experiencing a loss!

One of the largest emerging market high yield bond fund ETFs has nearly 10% of its assets in Venezuelan debt (both public and private). I understand the fact that Venezuela has issued many debts and therefore is a big part of the emerging market bond index. But must the simple fact that Venezuela is so heavily indebted also imply that Venezuela is a good place to invest? Surely not. I would argue that the converse is true. Furthermore, if crude oil prices stay down, wouldn't strife-torn Venezuela suffer more than perhaps any other country on the planet?

Another large and popular US-centric high yield bond ETF has 14% of its assets concentrated in energy. Again energy has come to dominate the US high yield benchmarks due to the recent explosion of debt-funded drilling in high-cost US shale oil. Surely this is not a compelling reason to own MORE of such debt, but rather an argument to own LESS, especially with low crude oil prices threatening the solvency of many high cost producers.

This publication is no stranger to the dangers in the high yield market (Credit: Caught Leaning, 8/13/14, Crude Oil's Black Friday, 12/3/14). These problems in the credit markets continue. Every major sector of the higher quality, investment grade bond market is up year to date – including energy which is up 5%. But returns in lower quality, higher yield markets have been more mixed. Investors who “reached for yield” by owning the debts of much weaker borrowers have been disappointed, even within the same sector. Total returns to investors in the high yield energy markets, for instance, are down 10-15% year to date in secondary oil and gas producers, oil equipment, and integrated oil. How is it that some investors in bonds of stronger borrowers who took less risk were able to make returns 15-20% greater than those investors who took more credit risk? We discuss one such strategy we use in the following paragraph. A key lesson to learn is that the higher interest rates in lower quality bonds (higher risk) do not always result in higher returns. Sometimes, such as this year, the opposite is true. There is a proper time in every market cycle when investors may profitably take certain risks. This is not the time to take credit risk, as we have been warning for many months now (Is Credit Quality Peaking, 8/6/14, Big Problems Start Small, 5/21/14).

We are not afraid to employ the wide array of tools that the bond market affords us to make money at all phases of the cycle. Bond duration is perhaps the most misunderstood of all these tools (Our Bond Strategy: The Power of Duration, 9/8/14). Bond duration is the length of time in years it will take for the ongoing coupon payments of a bond to repay the principal amount borrowed. Our goal is to match our strategy to the appropriate point in the cycle, which is why we have not been afraid to harness the power of longer dated bonds - of the highest quality (What Does the Bond Market Know, 5/7/14).

Very high quality bonds of long duration can be a powerful weapon in an investor’s arsenal when used appropriately. Long dated US government bonds have appreciated 20% in price year to date while also providing a 4% coupon rate for a 24% total return this year. As the cycle progresses the carnage underway in the high yield energy market will create compelling opportunities once again for investment. The smartest thing we can do is to remain patient and opportunistically take advantage of compelling opportunities as we find them, wherever we find them.

We believe that it’s best for investors who own bonds to own them individually, where investors can monitor the health of specific companies. Research on individual bonds, and the companies whose liabilities they are, is a challenging exercise to say the least. But we believe the benefits of a custom tailored strategy get more important the longer the credit cycle endures. And it has endured for almost six years now. Now more than ever investors need to be able to use all the tools in the bond investor’s toolkit.

Shale Oil Versus Subprime Housing: is History “Rhyming?”

No one can be certain if today’s shale oil high yield debt is a repeat of the 2007 - 2008 subprime mortgage debacle when the worst performing bonds lost most, or even all, of their value. But could it be? Let’s examine the similarities: (1.) both shale oil and housing were the locus of trillions of dollars of investment, (2.) both sectors were seen as leadership sectors of great strength for many years, (3.) both were based upon a single assumption which, if it proved to be flawed, could threaten the underpinnings of the entire sector: the price of housing (crude oil) could not go down! So could their bonds also share a similar fate? It does not take a herculean leap of logic to show that the collateral value of high cost shale oil assets could be worthless if the price of crude falls low enough and stays low for long enough to make the assets uneconomic. Mortgage bonds were equally compromised in the 2007 - 2008 period of falling house prices, with falling collateral value.

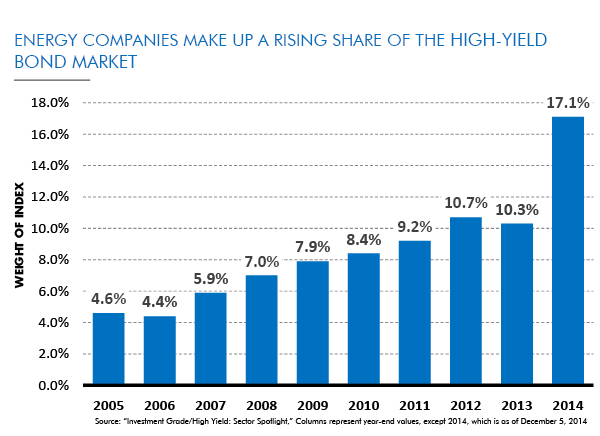

Between 2013 and 2014 year to date the share of energy debt in the high yield indices rose nearly 70% from 10.3% to 17% according to a recent report from Goldman Sachs (Investment Grade/High Yield: Sector Spotlight). This means that energy related high yield debts have grown to be an overwhelmingly large part of incremental high yield debt issuance. This is deeply troubling indeed since our framework as cyclical investors has always been that an overabundance of capital showered on any one sector is likely to create overcapacity, falling profitability, and credit stress. Even as late as 2006 energy related high yield debt was only 4.4% of the total high yield index (see below). This is the kind of aggressive credit growth that creates problems, especially for the sector where the over-investment took place.

Forbidden Fruit May Continue to Disappoint

This has been an unusual year, one where a seemingly larger than usual portion of investors’ expectations have not played out. Bond investors who were tempted by the alluring Forbidden Fruit of high yield energy bonds (just LOOK at those yields!) have been handed losses, even while investors in better quality bonds in the same sector have profited. Higher risk did not, in retrospect, equal higher return. We believe that the market is always presenting us with profitable opportunities to safely grow investors’ capital, if we remain clear-eyed about which risks are actually worth taking. The best way to grow capital is to avoid losses! We think it’s a worthwhile exercise for investors to take a deeper look at any high yield bond funds they may own. You might not like what you find in there. Let us know if we can help.•