The game of poker shares many similarities with investing. They are both odds driven endeavors where it pays to be logical. The margin of victory is often slim! If you play the game of poker long enough you are sure to see many examples of illogical and overly aggressive betting on weak hands. Luck in its capriciousness may smile on such bets from time to time – but does the fact that bad bets “win” make these bets rational? If the player made the same bet again and again would the cumulative result be a positive return? The answer is no. Likewise many poker players have confidently bet a great hand only to be saddled with losses on a freak draw of a card. Could anything be more frustrating!? Surely what is true for the poker player making bets is even more true for the investor allocating capital! The path of rationality, hewing strictly to the odds, is the most profitable pathway forward in an uncertain world - even though in the short run following the rules of logic does not guarantee success!

Investing is an exercise in decision making under uncertainty. But thoughtful analysis can create an edge, a competitive advantage, for the informed analyst to make money in the stock market. The tools that the investment analyst uses to tilt the odds in his favor include financial analysis, strategic thinking, and common sense. Perhaps the most valuable tool of all is an investor’s attitude. When I reflect back upon the attitude of the most successful investors four characteristics come to mind: flexibility, rationality, simplicity and above all patience. Patience is definitely the ingredient that binds the whole together. In this week’s “Trends and Tail Risks,” I walk through the recent example of the inventory destocking cycle and ask what is next for the markets.

“Unexpected” Change Drives Markets. But Can We Anticipate Change?

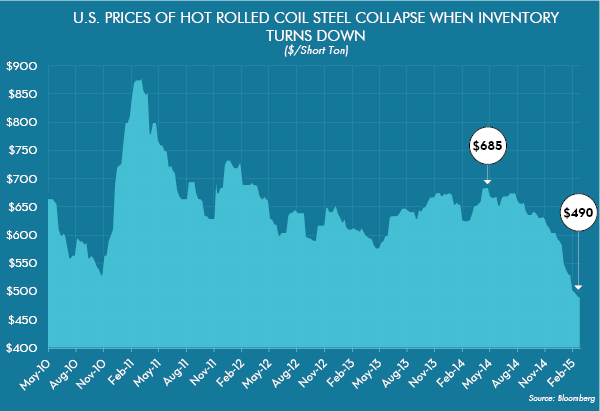

On May 28th of 2014 (Making Volatility our Friend: Trading the Kitchin Cycle, 5/28/14) I began to write of the rich premium at which U.S. steel prices traded versus those prices prevailing outside our shores and how a turn in the Kitchin Cycle driven by falling inventories would be the likely catalyst to eliminate that premium. This analysis was simple and rational – but early! As so often happens in cyclicals, extremes ran to even greater extremes. But did this in any way invalidate the thesis? Hardly. Was it frustrating? Infinitely.

The Unsustainable Balloons into the Indefensible…

On September 3rd of last year I revisited the steel markets (Unsustainable Steel Premiums, 9/3/14) outlining the logic of how the unsustainable had turned into the indefensible. U.S. steel prices were trading at such a premium to those outside of the U.S. that the odds of mean reversion, of falling U.S. steel prices, were forty-five to one! What amazing odds! Surely such an extreme outlier warranted a large investment! Prices had in fact already peaked four months prior yet enthusiasm for high-cost U.S. steel producers grew even as the ground crumbled beneath their feet. Remarkably the share prices of high cost steel equities nearly doubled (!) in the next three months even while steel fundamentals worsened. How can this possibly be rational? One culprit behind this paradoxical behavior was the lagging earnings expectations of many published steel market observers, especially those employed by investment banks as experts. This analytical community of seasoned veterans somehow managed to miss the signs that change was coming. I can promise you that this was a very frustrating three months for me.

And then it Crashed

Analysts’ earnings estimates for these equities have now fallen 70% or more since August and in some cases swung all the way from profit into loss. Equity prices fell in tandem, some as much as 70% or more from the peak. Such is the capriciousness of cycles: humiliating each in his turn, frustrating both bulls and bears alike.

The physical market had the final say. As always, price allocated resources (Prices Allocate Resources, 6/25/14) as foreign steel makers ramped up their exports to the U.S. in response to our overly generous prices. Imports created oversupply, which weighed upon U.S. prices. Hot rolled coil steel prices fell from a peak of $685/short ton in May to $490/short ton yesterday. Frankly, U.S. prices still remain too high and are likely to come under further pressure. But a key difference between now and last September is that the market’s expectations are now much more in line with reality. Last year’s maddening and unfounded enthusiasm about near-term earnings growth in the high-cost U.S. steel producers is now gone. The inventory cycle washed it away.

From the Specific to the General: Other Insights from the Inventory Cycle

We watch steel closely because it’s the most representative measure of the inventory cycle. Once the inventory cycle peaked in steel, it was easy to forecast a downturn in other markets as well, because the inventory cycle tends to be a global industrial event. The downturn from the peak of the inventory cycle would break the crude oil market (Crude Oil's Black Friday, 12/3/14), stress the high yield debt market (Credit: Caught Leaning?, 8/13/14), reintroduce credit stress into the Eurozone through the Greek market (Greece: The Bank's Problem?, 2/11/15), weigh upon emerging markets and – as growth expectations collapsed - rally the price of higher quality, longer duration bonds (Our Bond Strategy: The Power of Duration, 10/8/14).

None of these “unexpected” changes need have come as a surprise – to those who had studied the inventory cycle. What a wealth of information we can find in something as simple as the price spread between U.S. steel prices and the rest of the world! But what else can we learn from the history of the inventory cycle? What other events may we reasonably anticipate?

What May be the Next Unexpected Change?

The inventory down-cycle could always extend and run for longer than I currently anticipate. To be clear: its work is not yet finished. Certainly there are other forces at work in the world beyond those of the inventory cycle that may exacerbate the downturn currently underway. Each will have its own impact on future developments.

But the market’s most profitable opportunities always lie in the successful anticipation of “unexpected” change. Quite possibly this is the hardest thing any investor must ever do: to leave behind the comforts of past successes to seek out new ones. Investors must have the discipline to exit a position and cash in their winnings once controversial views become mainstream. Never to be fully comfortable is the fate of the investor who is always striving. The burden of the value investor is always to be early.

Commodities: Opportunities Among the Carnage?

Commodities have been crushed in one of the most severe downturns ever recorded. Many prices fell a catastrophic 70% or more, as seen in iron ore, cotton, rubber and silver. An even greater number of commodity prices are down 50% or more such as crude oil, heating oil, corn, sugar, soybeans, live hogs, natural gas, and orange juice just to name a few. This is an epic collapse that finds few precedents in modern history. This does not mean that the down-cycle is over or that better days for commodities are imminent. But certainly thoughtful investors who appreciate the value of unexpected change must surely examine the wreckage of this sector for profitable opportunities. Few contemplated how bad commodities would perform over the last few years. Might their long-term future be equally surprising – in a more bullish direction? Stranger things have happened!

Destocking Cycles tend to Create Tradable Bottoms in Commodities. One thing is for Certain - Gold will Lead any Broader Strength in Commodities. It is Gold that we must Watch

The most virulent destocking phase of the inventory cycle historically puts in a very solid low for most commodities. This is true across the board for commodities in general because falling commodity prices lead companies to dump inventories in a mad scramble to avoid losses as prices fall. If the destocking is violent enough, prices may rally off of the bottom even in the face of awful news. Equities often anticipate this move in underlying commodity prices or at worst will trade in sympathy with real time improvement as an awful situation becomes slightly less awful. I have seen this happen too many times to ignore. Rational investors play the odds. These odds we must examine closely.

Far too much attention is focused upon crude oil right now. The miracle of crude oil is not that it crashed but why it took so long to crash in the first place. Leadership in commodities has always resided with the precious metals – especially gold. Gold leads because its price reflects the changing value of the currencies in which commodities are denominated. Rising gold prices are actually decreases in the purchasing power of the U.S. dollar.

The laws of microeconomics dictate that in the long run commodity prices move toward their marginal cost of production. Rising gold prices are a real-time prediction of rising marginal costs for commodities. This is the single most important – and misunderstood – truth in all of the commodity markets. Gold signaled almost four years ago that commodities would come under pressure. Crude oil did not lead the commodity complex down but rather was simply the last to fall.

Gold: Is there any Hope?

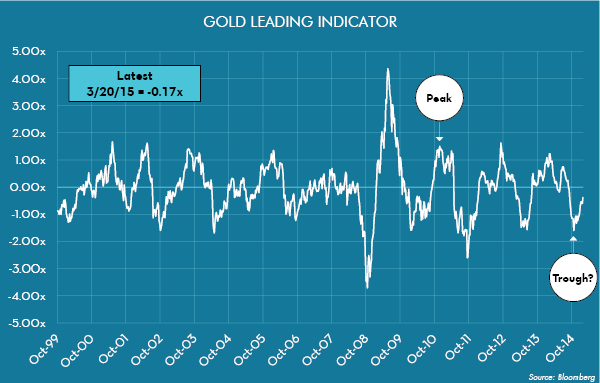

Gold’s peak and down cycle that began in late 2011 heralded this violent bear market for commodities. Gold’s own peak was foreshadowed by weakness in my leading indicators that peaked in late 2010, as the chart below demonstrates.

Every fundamental event has a cause and therefore – a leading indicator! It’s possible that gold may be bottoming now. This is the tentative message suggested by my gold leading indicator and is consistent with our view of a secularly over-indebted world. If gold were bottoming, that would be the most important development in the world of commodities in four years. Gold is “only” down approximately 40% and thus has not yet challenged the historic depths of its most extreme sell-offs, such as the 50% correction from 1974-1976 or its bruising 63% correction off of the 1980 secular highs. History is clear on one thing however: commodities will languish until gold bottoms.

Perhaps the ultimate low for gold remains in the future. Certainly the commodity markets have proven their ability to overshoot, like the nonsensical rallies in the prices of high-cost U.S. steel equities last year. The unsustainable can indeed all too easily turn into the indefensible! But what does the future hold?

Thoughtful investors will watch - and wait - with an open mind. History suggests that the unexpected shock of the inventory destocking cycle should have largely spent its force. Will history repeat, and a tradable rally in commodities follow? Only time will reveal the ultimate turn in the commodity cycle, which will begin in gold. Time and time again the market proves that it rewards those who anticipate “unanticipated” change. Often the more controversial the change appears, the more profitable the rewards may be!

The Constant of Change

Change is ever present - especially when it comes to investing. Investors and fiduciaries cannot afford to be backward looking. It is the future and not the past where potential profits lie. Our analytical team must understand dispassionately the odds we face in our investments. We must follow the rules of rationality. This is the only sound basis for long-term success. This is what Ben Graham, the father of value investing, meant when he said that in the long run the market is a weighing machine.

Often no amount of analysis, no matter how sound, prevails in the very short run. Ultimately we need to pair the proper analysis with the patience it requires to see our conviction through to a profitable end. Now at the successful conclusion of our steel investments we have to ask ourselves: what is the next big change? If there is one thing I have learned in all my years of investing it’s that one can never be too open minded! •