Baseball is back! With the return of April and the rainy season here in south Florida, baseball has returned. As thoughts turn to baseball, I am reminded of the epic 1991 season for the Atlanta Braves. The Braves had the worst record in baseball in 1990 but in the next season mounted an amazing comeback to clinch the division on the second to last day of the season. No team had ever mounted such a stunning comeback of “worst to first.” I will never forget the energy in Atlanta during that season. All of us were captivated by that incredible turnaround story and the players that made it happen. A big part of the Braves’ success, in that year and the years to follow, was their pitching staff. No batters ever had to face a more intimidating roster of strong pitchers than the Atlanta Braves staff of the early to mid-1990s. When I think about all the baseball metaphors that lend themselves to investing, perhaps none is more appropriate than the importance of “seeing the ball.” Batters who are really on a hot streak talk of seeing the ball clearly. As they say, “You can’t hit what you can’t see!” Not all pitches are worthy of a swing, however. Many pitches are deceptive and fraught with risk. A rare few offer the opportunity of a lifetime. That is also the nature of investing. How to tell the difference when investing between a great opportunity and a mediocre one? In this week’s “Trends and Tail Risks,” I outline how our investment team tries to choose carefully the pitches at which we choose to swing.

Amazing Pitches: When a Cogent Thesis Combines with a Controversial Narrative

Two things define a truly great investment opportunity: seeing the ball clearly and understanding when the pitch, this particular opportunity, is truly remarkable. It is no mean feat to accurately analyze the fundamentals of a situation. This takes a lot of hard work and effort. Our analytical team must first create a cogent thesis, an internally consistent and well-supported explanation of exactly what is happening in the market and why. For instance, at what phase of the cycle do we find ourselves? What is the future earnings power of a company? Almost invariably the simplest answer to these questions is the best answer (Simplicity, 6/14/14).

But again accurate perception is only the first step of the process. Accurately perceiving what others already understand is not an insight that the market rewards lavishly. As the saying goes, that which everyone knows has little value. Rather the market grudgingly bestows its most lavish praise only on those who have mastered a controversial truth, who have a valuable insight.

Controversy is the magical ingredient that drives the most powerful investment returns. The most profitable moves in investing are when fundamentals and valuation reinforce each other. This only happens after radical change enters the scene: when events take an unexpected turn or when investors fail to recognize the true nature of a business. These unlikely combinations create the rare but beautiful days that you long for as an investor, when you can truly see the ball clearly – and when you know that it’s a pitch worthy of a powerful swing.

When we invest we are competing against the market, a pitiless opponent who – like the storied 1990s Braves’ pitching lineup - makes few mistakes. Rarely does the market hang a curveball, especially in a big game when the stakes are high. The market is far too much of a professional to make that kind of rookie mistake. Most often we have to be content with singles and doubles as we hit the pitches we can, not the pitches we want. When we are presented with a rare mistake it’s an opportunity to cherish. We must swing hard for maximum effect when we get the pitch we want. But such big swings can be costly if we fail to connect.

Errors of Omission and Commission

Many are the ways that we can fail at this endeavor. We can mistakenly see opportunity where there is none. We can over-commit to these deceptive pitches and incur costly trading expenses as we reverse our error or even worse – experience capital losses. Painful and frustrating are such errors of commission. Only a few such mistakes can erode your capital.

Just as ruinously - in the long run - the error of omission also bears witness against our mistakes. It can be painful to fail to see the rare fat pitch as the unique investment opportunity that it is. Such opportunities are rare.

The world is filled with so many mediocre ideas masquerading as something more appealing than they really are. How can we train our minds to recognize the rare opportunity that can so easily elude us? Thankfully, there is a way to systematically examine the world of investment to thoughtfully identify the most compelling opportunities of the day, as we explain below.

Where to look for amazing pitches? Start by working backwards! Let valuation be your guide. And be open to reversals in long standing trends – especially where unanimity of opinion rules the day.

Valuation is the best place to begin a search for the breakaway investment opportunities of tomorrow. After all, the first step in making money is not to lose it! Investments with a margin of safety can allow us to invest with less risk of loss and allow us to be patient while fundamentals improve.

Replacement cost is one of our favorite valuation metrics (From the Analyst’s Toolkit: Replacement Cost Valuation, 6/11/14). Replacement cost tells us many things about a company, the quality of its management team, and the market’s view of the company’s future.

For instance, when a stock is trading at a premium to the replacement cost of its underlying assets, the market is encouraging that company to expand. Let me explain. Such highly valued companies can sell stock at inflated prices to raise capital. Companies may then use the proceeds to invest in new productive assets at a value equal to the replacement cost of the underlying asset. In this way a company may rationally grow its capacity per share. Per share growth is exactly what we want to see as equity holders, because our ownership of the company is through its equity shares. In essence, when a stock is trading above the value of the replacement cost of its underlying assets, the market is offering to fund capacity additions. Over time this can facilitate overcapacity and weaken returns.

Conversely, when a company trades at a discount to the underlying value of the company’s assets it means that the market is downbeat on the company’s prospects. Essentially the market is discouraging management from further reinvestment in the business. Such a company may still grow its capacity per share – its earnings power per share – through buying back its stock in the open market. This is after all a cheaper way to grow capacity per share than adding new capacity at full replacement cost. Over time these low valuations can deter new entrants and shrink capacity by starving existing participants of the capital they need to survive. Low valuations also encourage consolidation in such challenged sectors.

It is these stocks that trade at distressed valuations, at less than their replacement cost, that hold our greatest interest as new potential investments. Their low valuations limit our downside and give us multiple ways to win: fundamental improvement, the sale of the company, better industry structure, etc. We believe that the long-suffering commodity sector, and certain emerging markets, have the most favorable valuations right now for our new investment. These sectors have suffered tremendous price declines, as we illustrate in the two examples below. We believe that their recent dramatic underperformance is setting the stage for future outperformance.

What equities in our view fit this bill? Bracell and Vale are two examples where equity prices have crashed – creating what we believe is compelling value.

Bracell (ticker symbol 1768 in Hong Kong) is the world’s lowest cost producer of dissolving wood pulp, made from trees, and has a host of consumer applications such as rayon fiber. Bracell has a 2.6% dividend yield and trades at 2.5x its trailing operating cash flow (according to Bloomberg). The last leg down to its near 90% decline, see chart below, is deceptive as the company paid out a HKD $1.40 special dividend. Nonetheless the company’s low valuation values Bracell at approximately 40% of the cost to replace its pulp mills and tree plantations. The cycle has crashed yet Bracell as a low cost producer will survive and, in an upcycle, would thrive. We believe this makes Bracell a compelling stock to own.

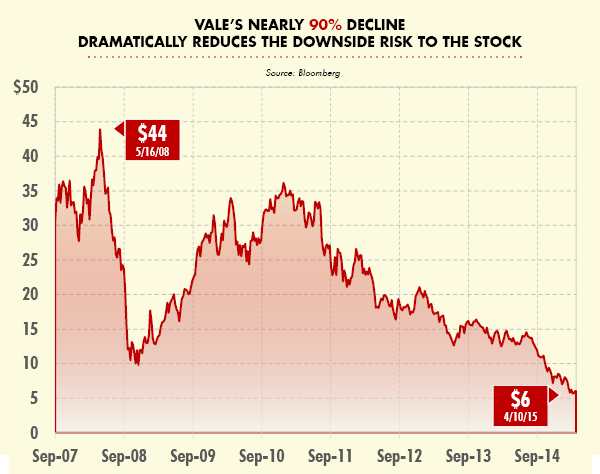

Vale, (VALE) the world’s low cost iron ore producer, is another stock that we are comfortable patiently holding. Our valuation work places the shares at close to a 50% discount to the replacement cost of its assets. The stock’s near 90% decline, see chart below, has chased off all but the most patient and valuation sensitive investors. The stock’s 6.5% dividend yield and investment grade balance sheet give us comfort as we wait for stabilization in the long suffering iron ore market. We believe this is forthcoming as current iron ore prices are unlikely to be sustainable in the long run. No one knows for certain what the future may hold, but it’s hard to not be enthusiastic at owning a world class asset at a price almost 90% off of its high and at a 50% discount to its underlying assets.

Changing Investments for Changing Times: Taking Gains on Once-Controversial Investments once they become Mainstream

In the last few days our clients have no doubt noticed that we have harvested gains on long duration bonds whose merits we have long extolled (Our Bond Strategy: The Power of Duration, 10/8/14). We continue to believe that long term interest rates will be a lot lower for a lot longer than almost anyone believes. Let me be very clear: it is my view that the secular bull market for high quality bonds has much farther to run. Few investments, however, travel in a straight line from victory to victory. Our bullish take on bonds was deemed as absolute heresy more than a year ago. Increasingly our once controversial views are now being embraced. Yields are falling globally, confounding the bond bears. Consequently, it’s a good time for us to reduce our largest positions in these investments and rotate on to the next controversial investment idea: commodities.

Does compelling valuation unite with a controversial narrative in commodities and emerging markets to create a meaningful long run opportunity for investors?

In recent weeks we have written of the ending of the inventory destocking cycle (The Power of Continuous Learning, 2/18/15) and the closing of our short investments against high cost U.S. steel producers (Unexpected Change, 3/25/15). We have noted the increasingly compelling valuations of stocks in the commodity and emerging market sectors (Unexpected Change, 3/25/15). It took years of underperformance for these sectors to become so cheaply valued. Might they be ready, after many years of underperformance, for sustained improvement?

Unprecedented Commodity Crash: Is it Time to Invest?

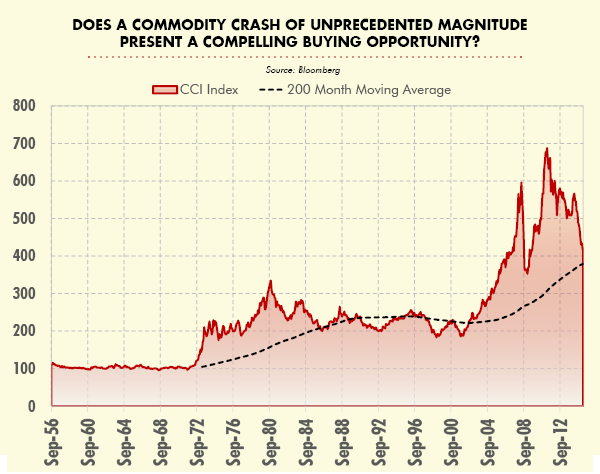

As the chart above illustrates, commodity prices – so far - are now down year to date for the 5th year in a row. In the post-World War II era there has never been a full consecutive five year decline in commodity prices – not even after the secular peak in 1980! Will commodities end the year with a record-breaking five consecutive year decline? Already the more than 40% decline in the equal weighted CRB index (CCI Index in Bloomberg) has matched its greatest post-war collapse. Can there really be much downside from current levels? Sentiment is abysmal. All hope seems lost. To the contrarian, this is the raw material from which great long-term returns may be forged.

An increasingly common theme is clearly running through how our portfolios are positioned. More and more steadily we are seeing the drumbeat of a broad-based reflation, of rising inflation expectations, falling real interest rates, and a spreading recovery outside of the U.S. expressed in rising stock market values. Is a cogent narrative now combining with a controversial view? Certainly this would be fully consistent with a change in the inventory cycle from destocking to restocking. This is also consistent with firming commodity prices, firming international stock prices, and improving credit conditions that had worsened dramatically in many parts of the world. All of these events we can reasonably expect to accompany an improvement in the inventory cycle as it swings from destocking to restocking. I have learned through much painful experience: it never pays to fight the inventory cycle!

Of course, even more importantly, our investment team can combine select undervalued investments that we have studied with this more constructive outlook to create portfolios that we believe are primed to outperform. Only the future will tell for sure – but I like my odds! •