Successful investing is driven by profitable disagreement with the market. Investors must have the conviction of sound reasoning behind their disagreements. Put another way, the biggest profits are earned when an investor’s view of what is true is different from that of the crowd, whose collective actions drive market prices.

But can we as investors count on the truth to always win out? Is there, in fact, an objective reality in the markets in which investors can unfailingly trust? In the long run I would say that the answer is “yes,” but sadly for some seemingly interminable periods the answer is actually quite often “no!” This is a key reason why my counsel is always for patience!

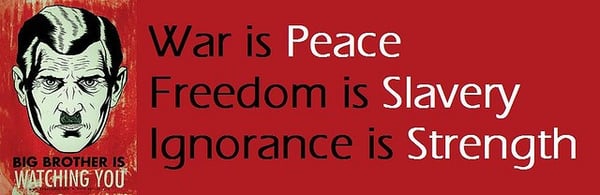

Dealing with this paradox, that “truth” changes in the short run, is one of the greatest challenges of navigating today’s Orwellian markets. Orwell’s 1984 suggests the disturbing reality that “truth” is determined by those with the power to make it true. In a bull market, looming problems are glossed over because the bulls are in charge, climbing the proverbial wall of worry. While in charge they have the power to validate the truth as they see it.

Flip the polarity of the market, into a bear market, and the long-ignored problems suddenly tower menacingly over the future. Suddenly, such as during the last few weeks, none of the old ‘truths’ seem to matter. Is there a method to inform us about who is in charge of our volatile markets – bulls or bears? I think the answer is “yes."

Navigating Orwellian Markets

A few short weeks ago markets were rallying hard into the end of the year. Now many prices are collapsing in the worst start to a year in the history of the U.S. stock market. Could the fundamentals really have changed that fast? No! Certainly the balance of power shifted. Perhaps it was the market’s earlier ebullience that was misplaced? Perhaps simply the bears are now in charge, for a while anyway.

My strategy for dealing with a volatile market is to methodically change portfolios today to profit from the fundamentals that I expect in the future. Sometimes this means that I will be early. As investors we live in the real world and must manage accordingly. There is always more that can be done. Thankfully we have already positioned assets defensively for a challenging market. My motto is always: Panic Early – beat the rush!

Many commentators would have you believe this market weakness sprang out of nowhere. Do not be deceived. These forces have been at work for a long time. This research publication has been focused on the spreading problems in global credit for more than 18 months now, (“Big Problems Start Small,” May 21, 2014). For a long time the market did not care about these signs. Now it cares a great deal. Surely I cannot be the only investor who finds this manic behavior erratic and frustrating!

Truth vs. Untruth: Seeking Objective Reality in the Financial Markets

To me, one of the most terrifying parts of 1984 is the torturing of Winston by O’Brien, a key member of the dreaded “Thought Police.” O’Brien’s actions and words are clearly those of a madman. Nevertheless O’Brien continuously asserts that Winston is the crazy one. I find it disturbing that O’Brien is in a position of total power over his helpless victim, Winston. Through months of continuous torture, O’Brien breaks his victim’s will and his mind. Winston eventually capitulates and abandons his earlier belief in an objective reality.

Winston confirms that he is now crazy, just like his demented tormentor, when he embraces the view that “sanity is statistical.” In other words, what is true is what the Party, the crowd, says is true. There is no objective reality. Investors often find themselves in similar straits. Markets have the same power to make the false true – for far longer than anyone would like to admit.

Does Successful Investing Demand that Sanity is Statistical?

Investing is not a debating society nor do investors profit from pure, unadulterated “rightness.” Investors only profit when their correct insights come to be shared by the market. If there is a delay in the market reaching a conclusion, for instance, that I reached long ago, it does me no good at all. The “correctness” of my insight is irrelevant until the market believes that my insight is accurate. Frankly, this raises all kinds of disturbing questions.

How early is too early? At what point does an investor lose his conviction? If the market continues to ignore our views, how do we deal with the growing cognitive dissonance between what our research has lead us to believe and what the market believes? Are we brilliantly insightful and just early, or are we crazy? Or is it the market that is crazy? If the market stays crazy long enough, does that make it sane?

Know Thyself

One of the more important things that any of us can do is to heed the counsel of Socrates and “know thyself.” I have come to understand from my last 15 years as a professional investor that I see problems early. This publication has chronicled my views for much of the last two years. Frequent readers will be familiar with my concerns about the risks to asset markets beginning in May of 2014 when the Kitchin inventory cycle was peaking (“Making Volatility our Friend: Trading the Kitchin Cycle, May 28, 2014), followed closely by a top in the credit markets (“Is Credit Quality Peaking?” August 6, 2014). A more comprehensive list of our concerns can be found in the archives on our website. So from my perspective, the question is not why markets have been weak the first part of this year, but rather, why it took them so long to be weak in the first place?

As I outlined in this publication a few weeks ago (“China Deflationary Wildcard: Lessons from the Past,” January 13, 2016), one could arguably trace the roots of this market weakness all the way back to Chinese credit problems that first appeared in 2011. The greatest challenge for me as a market participant is patience, allowing a sufficient amount of time between when I identify concerns and when others in the market share my concerns.

Sometimes this seemingly takes forever, like the concerns I have expressed over the credit markets since the summer of 2014. Like Winston, I found myself hostage to a market whose sanity I doubted, while the overwhelming power of the markets’ prices drew my own sanity into question. In those instances, like Winston, I may refuse to “make the act of submission that is the price of sanity,” and persist in my disagreements with the market.

Other times, the problems I identify quickly express themselves in a surprisingly vigorous crescendo, such as the weakness in the Italian banking system ("Interplay of Cycles; Inventory Restocking vs. Long Term Debt Cycle," November 18, 2015). Some Italian banks are down 40% year to date over concerns about their 200 billion Euros of bad debts. Just last week the Italian banking authorities in their wisdom banned the shorting of Italian banks. This is an obvious sign of extreme distress that I have not seen since October of 2008 during the worst phase of the U.S. financial crisis. Will the past be prologue?

“Doublethinking” Our Way Through an Increasingly Orwellian Market

Maybe O’Brien is onto something? Perhaps the way forward is “doublethinking,” to hold two contradictory ideas in your head at the same time and believe them both. I take prudent steps in advance of the troubles I foresee, understanding that I will be early. I identify and chronicle in the pages of this publication rising tail risks while seeking to remain intelligently involved with the markets, through an asset allocation that is prudent for that particular market.

Others May Not see in the Markets the Fundamentals that we see

O’Brien counseled Winston against assuming that others see the world as Winston sees it. This too is sound investment advice. One tool I have learned to use is the information in the market itself to try to understand if the market is close to embracing reality as I see it. This is why readers of this publication are treated to such a litany of obscure prices and quixotic relationships, such as scrap steel in Turkey, fishmeal in Peru, the market’s expectations for real interest rates, credit spreads, or the gold/silver ratio. These seemingly odd indicators, and many more, all hint at what reality the market may embrace.

I have always been a proponent of studying the information in market-driven prices. Prices are a powerful tool that the market uses to balance supply and demand. Prices make things happen. Prices are deeply fundamental.

But there is another equally valid way of thinking about prices. Price movements are driven by disagreements among market participants over the future course of the fundamentals. As the fundamentals play out, one side or another of the argument will be validated, and prices will rise or fall accordingly. The problem is that the market is unpredictable in the short run. Just look at the last few weeks. Why come unglued now? None of the issues that the market is facing are new.

In Conclusion

One path to success in the markets is to watch sensitive indicators and otherwise obscure intra-market relationships. My goal in doing so is to understand who has power in the markets: is it the bulls or the bears defining reality? Each extreme has its own very different view of reality. Bulls often ignore warning signs until it is too late. Bears often see nothing but problems.

Sensitive indicators, like a rising gold/silver ratio or distressed credit spreads in China, have been sounding a warning for almost five years now. But still many markets continued to find a way forward while others fell away. The trick is to move forward, to embrace the reality that the market rewards, while never losing sight of how weakness can spread. No one said investing would be easy! Heeding these sensitive prices and ratios of market driven prices, however, can help.

Many successful investment views begin as a minority of one, but they cannot remain a minority of one if they are to have a successful conclusion. Sanity is statistical, after all. If you can combine a proactive asset allocation strategy with deeply held conviction, resulting from fundamental research, you should have a portfolio that can prosper and succeed, even in the most Orwellian of markets. •