Chief Conclusion

Expect the ongoing bear market in confidence in central bankers and their minions to power a long and enduring bull market in gold. They are, in fact, one and the same thing. A falling gold/silver ratio suggests this trend will accelerate in speed and strength.

We have just witnessed one of the bond market’s most powerful rallies in memory, and yet are left with several spare fingers on the one hand we use to tally up those who forecasted this move or profited from it. The “Brexit” vote revealed the dangers that had been lurking underneath the surface. Brexit reinforced three powerful trends that were already underway: 1.) the collapse in long term interest rates; 2.) the free fall in the share price of European continental banks; and, 3.) the surging price of gold. These trends share one common driver: overindebtedness. Investors, however, who have been following our research have not been caught flat footed – far from it.

For more than two years now we have also been clear in outlining the ways that investors may profit from this powerful trend in rising bond prices, rising gold prices, and falling European bank prices.

For rising bond prices see:

- “Our Bond Strategy: The Power of Duration,” October 8, 2014;

- “Negative Interest Rates?,” February 4, 2015;

- “Bond Market: Turning Japanese?,” December 2, 2015.

For rising gold prices see:

- “Gold: Price vs. Relative Value,” July 24, 2014;

- “Investing Safely in an Unsafe World,” December 30, 2015;

- “The Message of Gold,” March 23, 2016.

For falling European bank prices see:

- “Greece: The Bank’s Problem,” February 11, 2015;

- “Is Spain the Next Greece?,” June 1, 2016;

- “BREXIT: All Eyes on European Banks,” June 15, 2016.)

Among these trends, none is more powerful or should be as enduring as the strength we anticipate in gold. On the surface, these three trends have little to do with each other. If, however, we understand the foibles of our floating currency “system,” we can see a deeper, simpler, and more profitable reality.

Overindebtedness Increases the Risks in Our Monetary “System:” Beware of “Accidents from…[the] Unskillfulness of the Conductors of this Paper Money”

No one designed our current monetary “system.” Rather Richard Nixon’s desperate pre-election gambit in the summer of 1971 finished off what was left of the Gold Standard. Thus ended a monetary system that had endured in one shape or another for at least 300 years. Following its demise, the dollar’s value was allowed to “float.” Perhaps no one said it better than Nobel Prize winning Dr. Robert Mundell when he noted that our floating monetary “system” is really a “non-system.”

Now, more than forty years into this experiment, our non-system is starting to do strange things – such as price more than $12 trillion of global bonds at negative interest rates. Has there ever been a more clear indicator that things are now, in the words of Churchill, “thoroughly out of hand?” Will investors finally stop and ask themselves what they really know about the financial non-system that is responsible for the daily pricing of all their assets? We believe that now is the time when those who understand this non-system should be thriving. Our investment performance reflects this.

Our own belief has always been that, if investors want to prosper within this non-system, then they should surely undertake the time and effort to understand it. Almost 250 years ago the very father of economics, Adam Smith, warned us to be wary of “accidents from…[the] unskillfulness of the conductors of this paper money.” Why have the insight and warning of such a profound and visionary thinker gone so unheeded?

Adam Smith noted that the invention of paper money was indeed a tool that could serve mankind, but cautioned that its wings were “Daedalian:” subject to failure when used in hubris. Is that the message of $12 trillion of bonds with negative yields? Are central bankers’ wings failing? We believe that answering this question is vitally important to today’s investors.

Going Further: The Imperative to Understand Company-Specific Fundamentals and the Environment

Certainly investors already face a daunting task of bewildering complexity. Investors must analyze the fundamentals of a company, understand its prospects, the competitive threats it faces, and how to value its assets. That’s what so many people think of when they think of investing. And that is where most thinking stops. While this line of inquiry is necessary, it is not sufficient. We, however, go further. We believe that investors who understand both their investments and the changing environment in which those investments are embedded will be the most successful. Perhaps an analogy would help.

If all you had ever studied were ships, and you knew everything that there was to know about them, yet you were wholly ignorant of the ocean and how to navigate it, you could not convince me under any circumstances to let you captain my ship through tempestuous seas. Successful investing is about how to captain skillfully the ship of our savings safely into port.

It’s true that there is no rule book that explains our financial “non-system.” That does not mean, however, that there are no rules. We have spent years studying the markets and our non-system to create tools that help us to better understand and navigate the challenges our investments must overcome.

The Gold/Silver Ratio: Finding Out What we Don’t Know by What we do Know

Recently, we wrote of one such tool, (“Where are we in the Cycle? The Gold to Silver Ratio Weighs in,” October 7, 2015), which has always been one of our most sensitive, trusted, and reliable indicators to help us plot our course through the financial markets. Our goal is to heed the advice of the Duke of Wellington, to guess at “what is at the other side of the hill.”

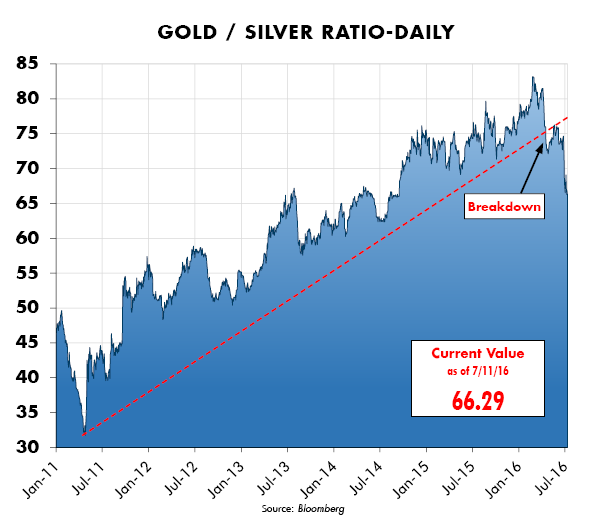

The chart below shows the ratio of the gold price relative to the silver price, the gold/silver ratio. Since 2011, this trend had been one of the most clear and enduring in our financial non-system, with a seemingly relentless rise in the value of gold relative to the value of silver.

Investors who understood this chart and were monitoring its progress were able to avoid obvious asset allocation mistakes and to profit from insightful capital allocation, as we explain below. Recently, a very important trend change seems to have taken place. If sustained, it could have profound implications upon our financial non-system and hence for all the world’s assets priced by that non-system.

When rising, this ratio demonstrates that the global forces of deflation are ascendant, because the purchasing power of gold, the money of the market, is rising. This insight would have helped investors to sidestep the bloodbath in commodities and emerging markets that until just recently were raging with an almost unprecedented ferocity. Furthermore, such times are consistent with elevated credit stress and disappointing nominal GDP growth rates, which help support the prices of longer duration, higher quality bonds.

When falling, this ratio often accompanies the strongest gold bull markets, during which gold often drags commodity prices higher through currency devaluation. Such markets may have improved nominal GDP growth and hence drive a temporary easing of credit stress. We carefully inserted the word “temporary” easing of credit because a debt-driven world remains saddled with debt long after its short-term “stimulus” has come and gone. The long-term outcome remains disappointing as the dead hand of accumulated debts weigh upon growth.

However, the path to this more reflationary outcome is fraught with risk, because it raises all kinds of uncomfortable questions about the market’s faith in the wisdom and skill of our central bankers, which is so crucial to our non-system and all the assets priced by it.

What Happens Now?

What does a falling gold/silver ratio mean for today’s markets? We believe it means we are entering into a more strident phase of the ongoing bear market in central bankers, which is to say, a powerful bull market in gold. Expect disillusionment with our central planners and their minions to grow and, in proportion to their fall from grace, expect the mirror image of a strong bull market in gold. How far could these forces run? History suggests very far indeed.

In Conclusion

We would conclude with two points that we believe highlight how very early we are in this unfolding trend. First, that consensus opinion remains far too bullish on central bankers, as indicated by non-stop fawning of the press over central bankers. Second, and more pressing, the catalyst of “Brexit” has revealed to others the key problem in our overindebted world that we had already identified: the days are over when central bankers could hike short-term interest rates with the power and freedom they once enjoyed.

With lower real interest rates dominating our future, and $12 trillion in bonds with negative nominal yields, what now can stand in the way of a powerful bull market in gold? Sooner or later even the most hidebound of consensus thinkers will stumble upon the imperative of asking this question, and may find themselves deeply uncomfortable with the answer: nothing.

Investors who understand how our non-system shapes the value of their investments are far more likely to profitably overcome the volatile trials that lie ahead. No doubt there will be unexpected twists and turns along the way. Profiting from cyclical change is never easy. But dependable tools such as the gold/silver ratio can help investors look to the future with confidence that they may find a profitable way forward. •