Chief Conclusion

Investors underweighting the highest quality and longest duration bonds are ignoring the tail risks of deflationary shocks from China and Europe. Such positioning may disappoint should these risks result in downside equity volatility. Investors who slight bonds for such “obvious reasons,” like upcoming Federal Reserve interest rate hikes and stronger U.S. growth, run the risk of making one of the oldest mistakes in the investing world: that of confusing the investment you really made versus the investment you thought you were making.

Last week I presented on our firm’s research process and investing framework to a group of prospective clients on the east coast of Florida. I always enjoy these opportunities to share with others the lessons I have learned over the course of my professional investment career. Although not what we named the presentation, I suggested it's title should really be “Learning from Twenty Years of Investing Mistakes.”

It’s true that I have been at this a long time. But the real measure of experience is not simply the length of time one spends beavering away in a chosen line of work, but rather in the variety of challenges faced and in the number of lessons learned.

I bear many scars from fighting in hundreds of investing campaigns. Sometimes it seems to me that I have seen it all: raging bull markets, mind-bending collapses, interminable calm, trends that lasted seemingly forever, sudden complete reversals of fortune, and instantaneous changes in sentiment. Through these challenges we learn. My goal with today’s “Trends and Tail Risks” is to share with you one of those lessons.

The biggest mistakes come not from the investment decisions you thought you made – but from the investment decision you didn’t realize you were making.

It’s possible that today’s bond bears are making such a mistake right now. Let me explain.

Right now there is a lot of optimism in the markets. Since the election, expectations for a stronger economy have driven the equity market higher. One side effect of this equity strength has been a weaker bond market, as investors disregard its promise of safety for the hope of higher returns in equities. Just this morning a strong employment report pushed investors’ conviction that the U.S. Federal Reserve will hike interest rates in March to record levels.

All of this combines to paint, for most, a dire picture of the outlook for bonds. Sentiment towards bonds is overwhelmingly negative. Bonds have few friends and almost no ardent supporters. For these reasons, and more, I can understand the investment decision investors believe they are making about bonds. However, I fear that these investors are missing the decision that they don’t know that they are making:

- Populism’s spread in Europe would be profoundly deflationary, not inflationary

- China’s weakening currency poses a long-term deflationary threat to this cycle

For reasons of brevity, I will not repeat the many arguments published over the last three years about the risk posed by countries in the Eurozone who have adopted the Euro as a currency, but who may reconsider that decision under different political leadership. For those readers who seek a more complete review I suggest referring to the following Trends & Tail Risks: Big Problems Start Small, Greece: The Bank’s Problem?, Contagion?, Greece: War of Creditors vs. Debtors, Is Spain the Next Greece?, Brexit: All Eyes on European Banks, Panic Early Beat the Rush, Trumpnomics on International Trade: The Times They Are a Changing.

Now let me be the first to acknowledge that events in Europe have dragged on far longer than I would have anticipated without a more forceful resolution. However, upcoming elections may accelerate that process and are worth monitoring. Should populism at the polls lead to a rejection of the Euro, we could see a tidal wave of capital flight from Europe seeking safety in U.S. bonds and possibly U.S. equities as well. This is an event that I would not want to bet against, yet many market participants are actually doing so when they bet against bonds.

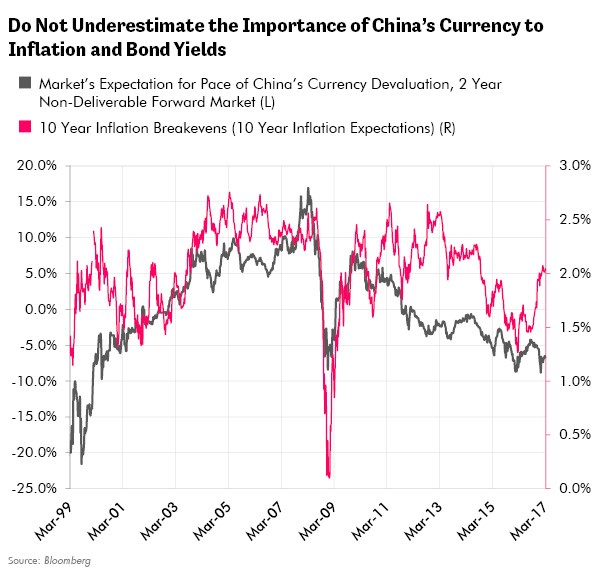

Furthermore, as the chart below demonstrates, investors who underweight bonds are also running the risk of an untimely unwinding of the debt cycle in China. China has suffered from $1 trillion, or possibly more, capital flight in the last few years. For students of credit driven booms and busts this makes perfect sense. The bigger the boom, the bigger the bust. And China’s boom has been huge, in fact the largest credit boom in recorded global history.

The chart below illustrates the remarkably close relationship between the market’s expectation for the future pace of China’s ongoing currency devaluation and U.S. 10 year inflation expectations. This makes perfect sense given that China is the world’s manufacturing leader, and any meaningful Chinese currency devaluation would be a negative shock to the whole world, lowering both growth rates and inflation expectations. Of course, this means explicitly that bond investors must consider the likely future course of events in China.

For these reasons, the second of the world’s deflationary tail risks resides in China, the evil twin of populist problems in Europe outlined above. A precautionary position in bonds as a hedge, particularly the longest dated and highest quality bonds, should provide portfolios some welcome protection against the unwanted and sudden return of either or both of these deflationary threats. The realization of either of these twin threats would likely lead to lower inflation expectations and falling growth, both of which are very favorable for bonds.

Would such a precautionary allocation to bonds underperform if the U.S. share market remains red-hot? Absolutely. The key to deciding an investor’s best course of action is to stay laser focused on the goals that the entire portfolio as a whole is meant to achieve. If capital preservation in challenging markets is a high priority for investors, then a larger precautionary bond holding appears to be advisable.

In Conclusion

Investing is always an exercise in decision making under uncertainty. Sadly, it’s impossible to work backward from a clearly-known future to identify and invest in “sure things,” buying only today the investments that our mythical, full knowledge of the future would guarantee to be successful. That is not the real world.

What we have to do, today, is to reach the most informed conclusion not just about particular investments, but also how they fit together as a whole in a portfolio. Our contention is that until there is greater certainty that our concerns about China and Europe are misplaced, thoughtful investors are wise to maintain a precautionary holding of higher quality, longer dated bonds as a hedge against these threats. Investors who fail to do so, slighting bonds for “obvious reasons” like upcoming Federal Reserve interest rate hikes and stronger U.S. growth, may find themselves disadvantaged by the decision that they made. By shying away from holding bonds investors are making the decision to ignore risks from China and Europe, which is a decision we are not willing to make. •