By Lewis Johnson - CHIEF CONCLUSION In the last four years, there has been an $9.1 trillion increase in negative yielding debt. The total now is $12.8 trillion. What broader impacts has this driven in our markets – and[…]

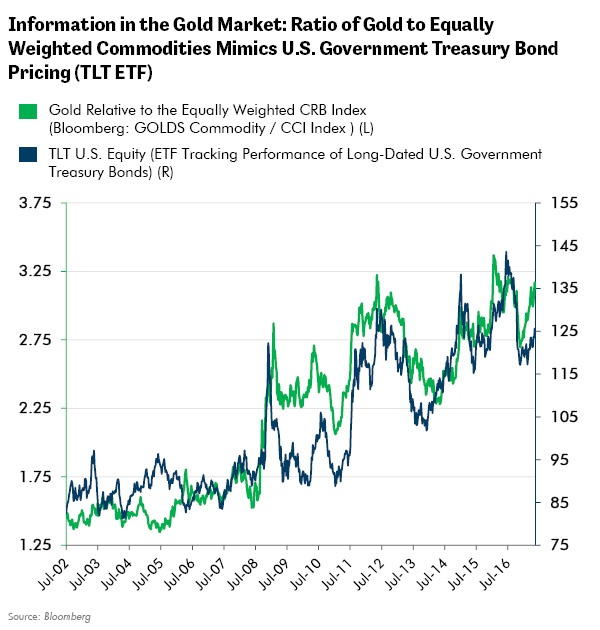

By Lewis Johnson - CHIEF CONCLUSION One of the biggest investment surprises in recent memory has taken place in two important markets over the past year or so: rallies in the price of gold and that of the U.S.[…]

By Lewis Johnson - CHIEF CONCLUSION What we believe to be the biggest change in decades is underway in monetary policy, which is creating new winners and losers in the markets. Central banks are selling hundreds of[…]

By Lewis Johnson - Chief Conclusion A month ago, we explained George Soros’ “reflexivity” to help explain why we thought more weakness lay ahead for many emerging markets. Since then Argentina’s currency has collapsed[…]

By Lewis Johnson - Chief Conclusion Asking better questions is the fastest way to make more money in the markets. In today’s “Trends and Tail Risks,” I will take a step back and explain the backstory of how asking[…]