By Lewis Johnson - CHIEF CONCLUSION There are two reasons why you should care about the ongoing meltdown of China’s overindebted property developers. The first is that, in my opinion, these debt-driven companies are at[…]

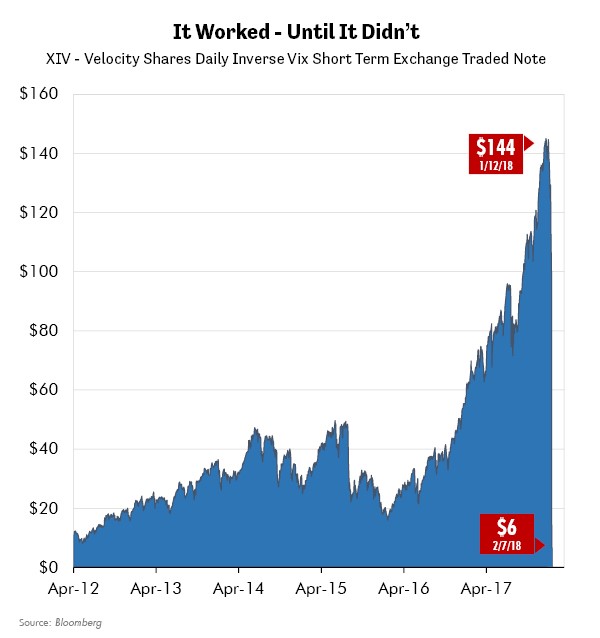

By Lewis Johnson - Chief Conclusion Prolonged market rallies act as a reinforcing mechanism to investors reaching for that extra yield without pausing to consider the risk associated with their actions. By no means is[…]

By Lewis Johnson - Chief Conclusion The most pressing problem that we attempt to solve for our clients is how to grow their hard-won savings thoughtfully. Money only grows when it takes risk – but what risks to take?[…]

By Lewis Johnson - Chief Conclusion Clients will begin to see a thoughtful winnowing of our selected holdings in corporate bonds rated less than investment grade. The relentless search for yield has resulted in a[…]

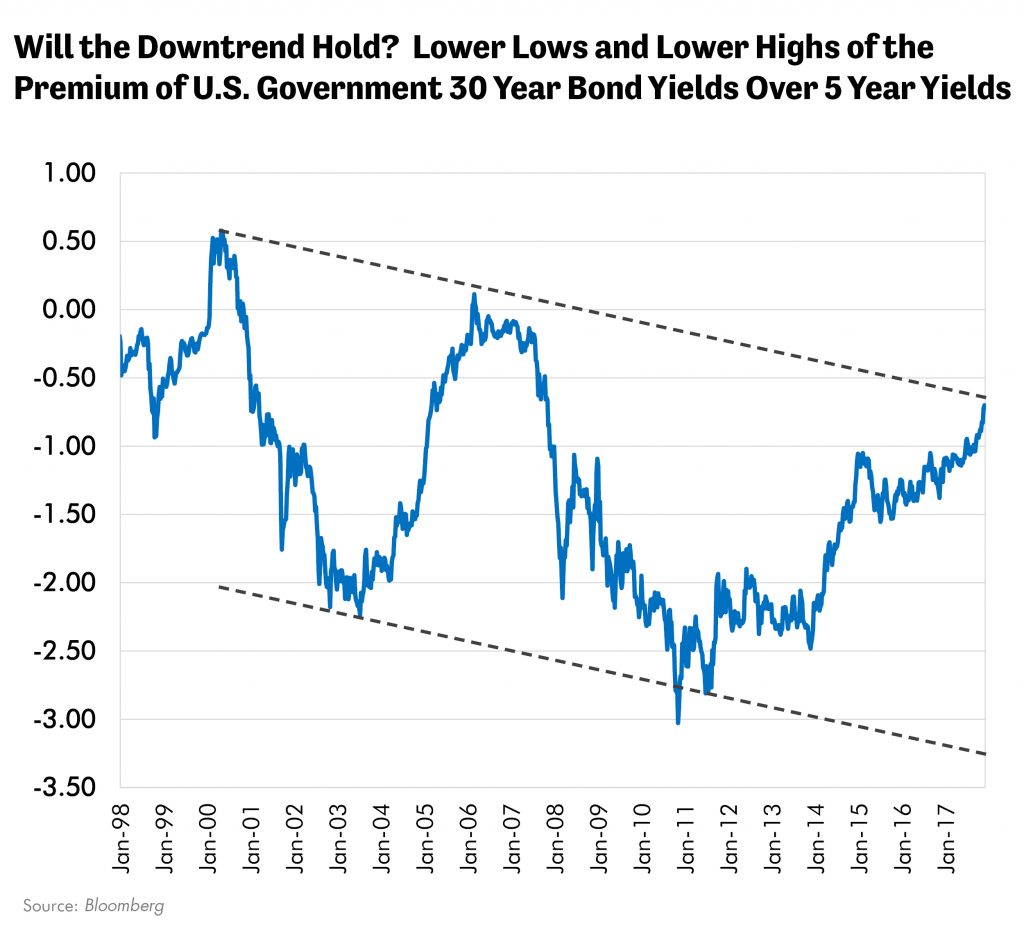

By Lewis Johnson - Chief Conclusion Evidence continues to accumulate globally that the secular bull market in bonds is alive and well. We discuss the most recent data that includes Europe’s first negative yielding[…]

.jpg)