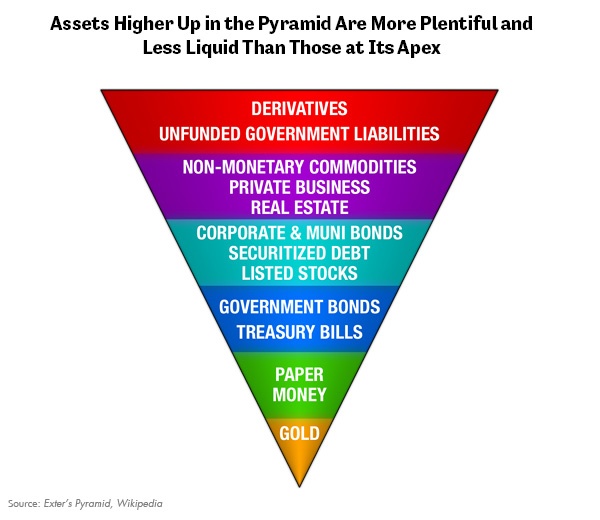

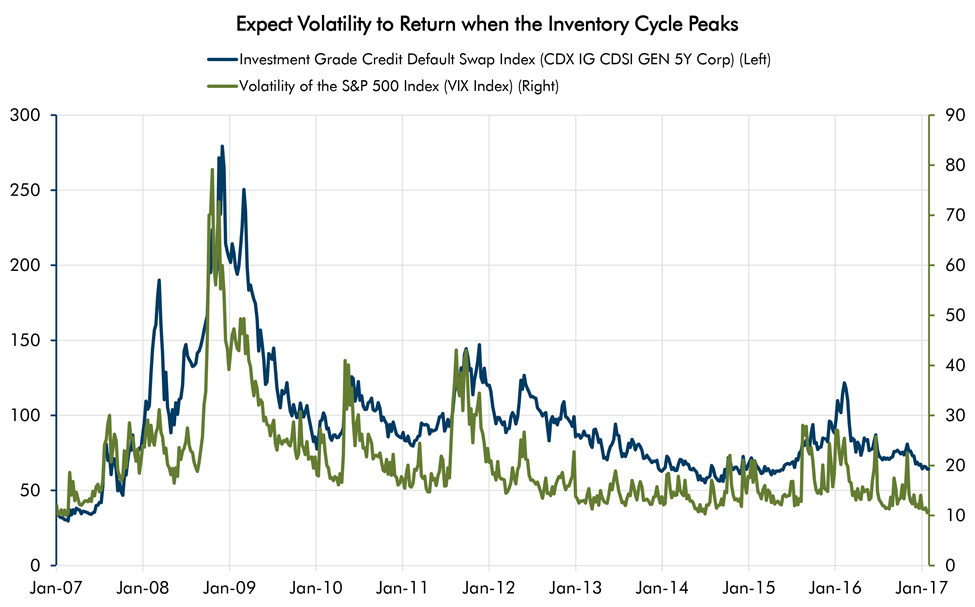

By Lewis Johnson - Chief Conclusion When danger rears its head, the mass of capital flees riskier assets to crowd into the much smaller quantity of safer assets, which drives up their price. Worsening credit quality,[…]

By Lewis Johnson - Chief Conclusion Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern[…]

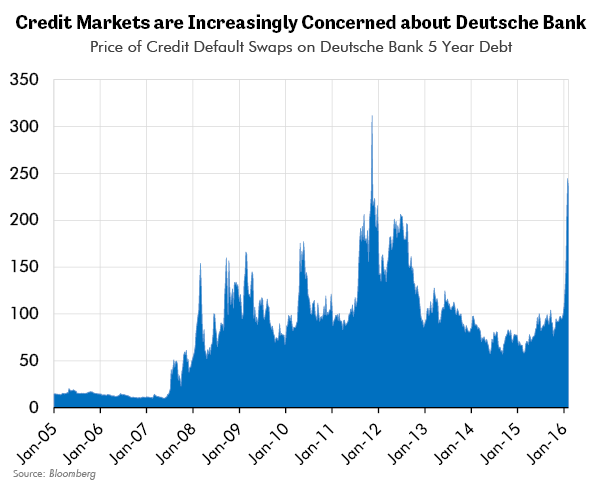

By Lewis Johnson - Chief Conclusion The 54% drop in the share price of Deutsche Bank (DB) in the last year raises questions about the health of our financial system. Shareholders at many other thinly capitalized[…]

By Lewis Johnson - Simplicity should be a constant goal in investing. Note the key word: goal. Sadly it’s a daunting effort to reach a simple understanding of our increasingly complex financial world. Often it takes[…]

By Lewis Johnson - The Fed made a mistake in raising interest rates. The consequences of this mistake could be far-reaching. Frequent readers know that I strive to follow the advice of Bismarck and study history to[…]