By Lewis Johnson - CHIEF CONCLUSION Since 2012, investors owning the S&P 500 have seen their money grow eight times faster than the return of the MSCI Emerging Market Index. Investors unfortunate enough to lug around[…]

By Lewis Johnson - Chief Conclusion A month ago, we explained George Soros’ “reflexivity” to help explain why we thought more weakness lay ahead for many emerging markets. Since then Argentina’s currency has collapsed[…]

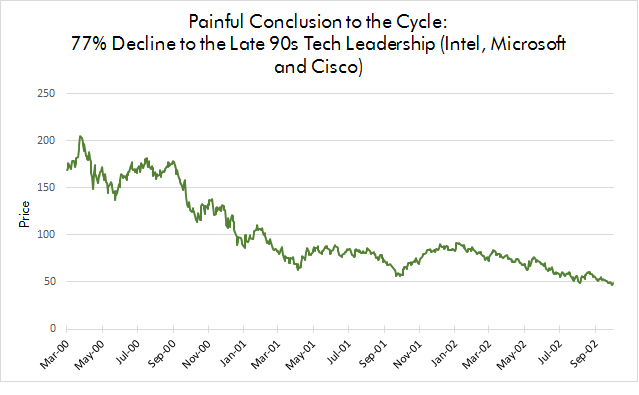

By Lewis Johnson - Chief Conclusion Today’s “Trends and Tail Risks” is about what happens to leadership stocks when confidence flees, and bull markets turn into bear markets, which has taken place on average every nine[…]

By Lewis Johnson - Chief Conclusion The world’s best investors are constantly learning, constantly trying to expand their circle of competence to make better decisions. Today I explain a recent revelation I had when I[…]

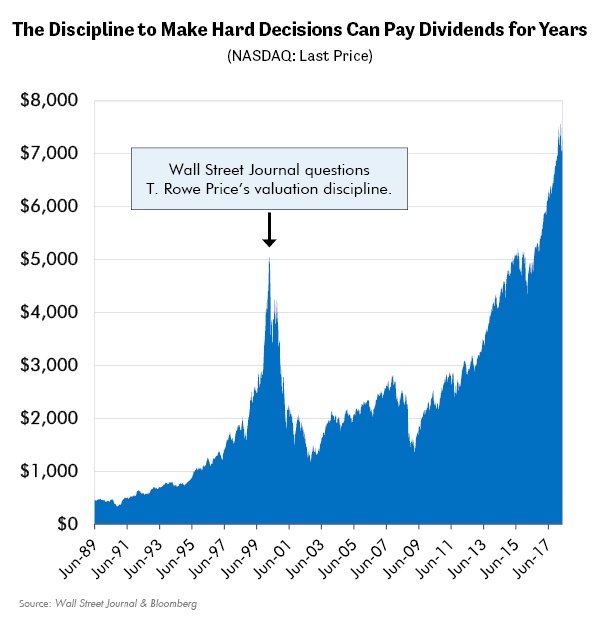

By Lewis Johnson - Chief Conclusion Our valuation discipline is at the heart of how we manage portfolios. Why? Because if you pay too much even for a good company, you can “be right” about the future and still lose[…]