By Lewis Johnson - Chief Conclusion Asking better questions is the fastest way to make more money in the markets. In today’s “Trends and Tail Risks,” I will take a step back and explain the backstory of how asking[…]

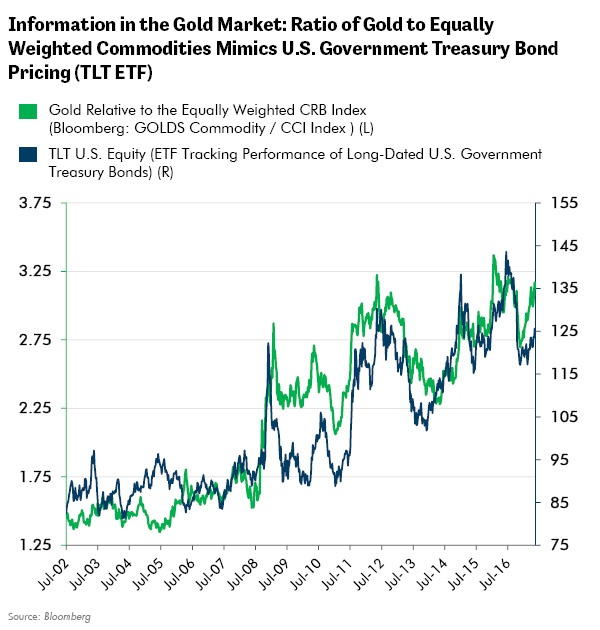

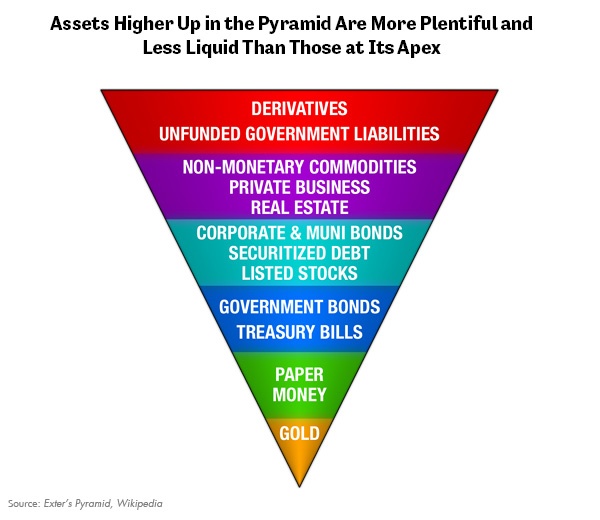

By Lewis Johnson - Chief Conclusion When danger rears its head, the mass of capital flees riskier assets to crowd into the much smaller quantity of safer assets, which drives up their price. Worsening credit quality,[…]

By Lewis Johnson - Chief Conclusion Clients are an investment firm’s most important assets. Our goal is to treat clients like the critical partners they are in the investment process. Working together with them, is our[…]

By Lewis Johnson - Chief Conclusion Investors must protect themselves from the Siren song of deceptively important “news.” While news can change daily, the value of a company’s assets and business change only slowly.[…]

By Lewis Johnson - Chief Conclusion The two most necessary preconditions for successful investing are 1.) insight and 2.) patience. One without the other will do you absolutely no good. Held patiently, a diversified[…]