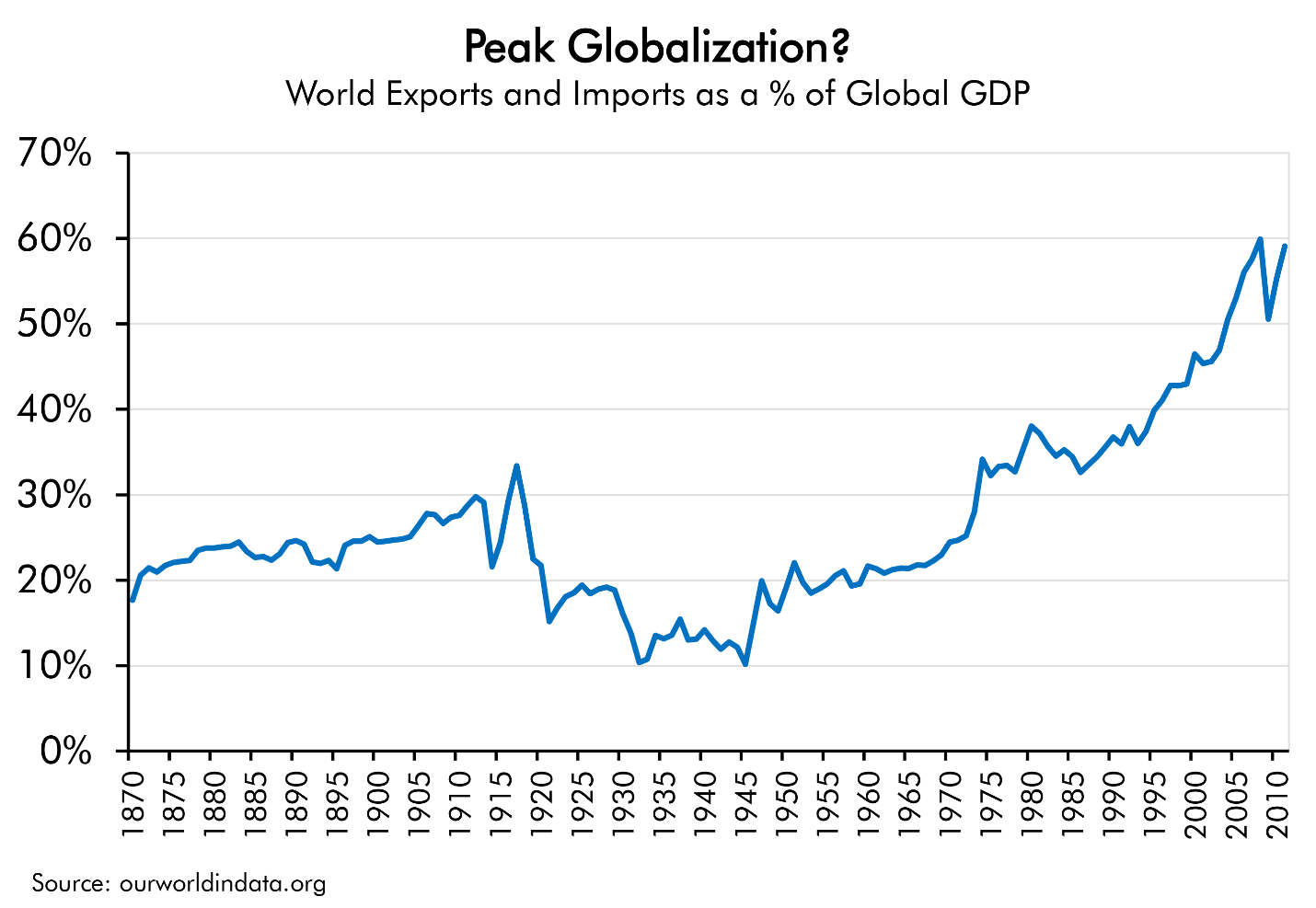

By Lewis Johnson - Chief Conclusion We expect that the upcoming Presidential election in the U.S. may add further evidence supporting the growth of a powerful and global bull market in populism and its corollary,[…]

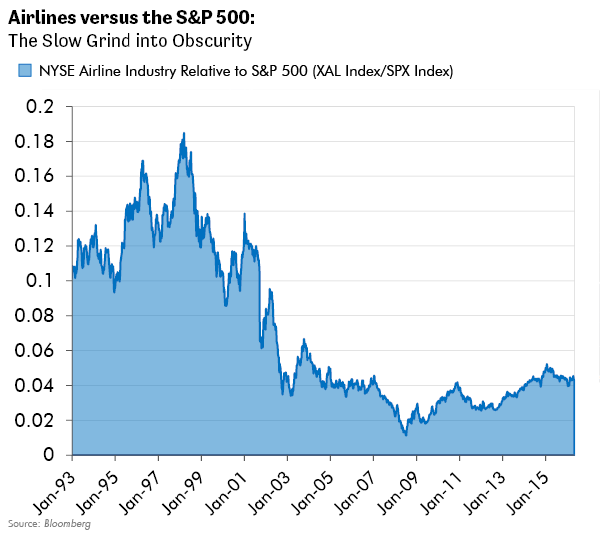

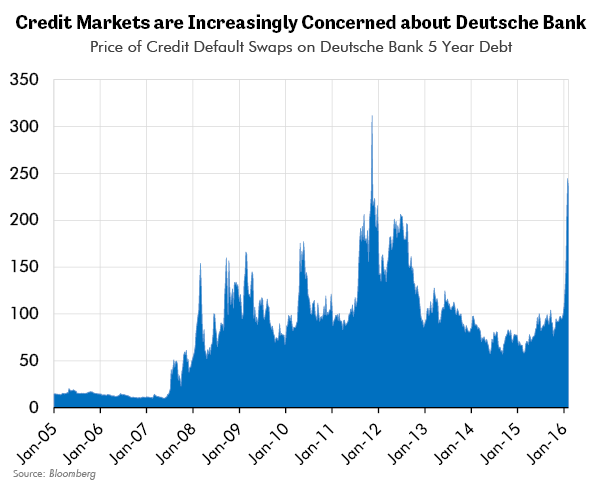

By Lewis Johnson - Chief conclusion England’s upcoming vote on June 23rd may be the first of several votes that reveal the deep flaws embedded in the European Union. In particular, Europe’s undercapitalized and[…]

By Lewis Johnson - Chief conclusion Give each investment a fair and open-minded hearing, because the world is constantly changing.

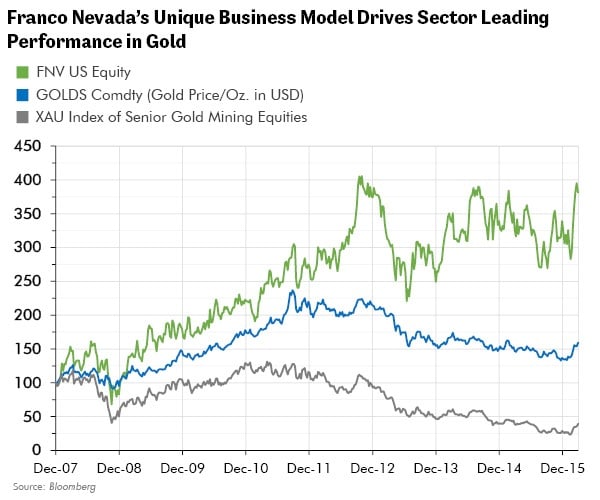

By Lewis Johnson - Gold is up 19% year to date against the backdrop of a volatile stock market. In fact, gold just clocked its strongest February since 1975. Is this the move we have been waiting for in gold? We[…]

By Lewis Johnson - The Fed made a mistake in raising interest rates. The consequences of this mistake could be far-reaching. Frequent readers know that I strive to follow the advice of Bismarck and study history to[…]