By Lewis Johnson - Chief Conclusion Clients are an investment firm’s most important assets. Our goal is to treat clients like the critical partners they are in the investment process. Working together with them, is our[…]

By Lewis Johnson - Chief Conclusion Investors must protect themselves from the Siren song of deceptively important “news.” While news can change daily, the value of a company’s assets and business change only slowly.[…]

By Lewis Johnson - Chief Conclusion The two most necessary preconditions for successful investing are 1.) insight and 2.) patience. One without the other will do you absolutely no good. Held patiently, a diversified[…]

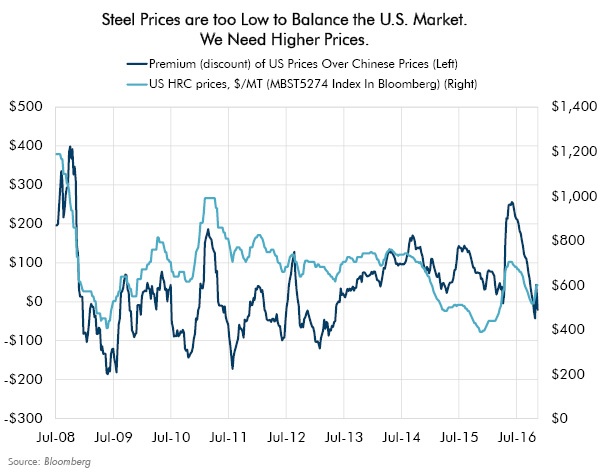

By Lewis Johnson - Chief Conclusion Our bearish outlook on the steel industry in mid-2014 helped us to avoid the huge declines in steel equities, some as high as 85%, that followed in the wake of the inventory cycle[…]

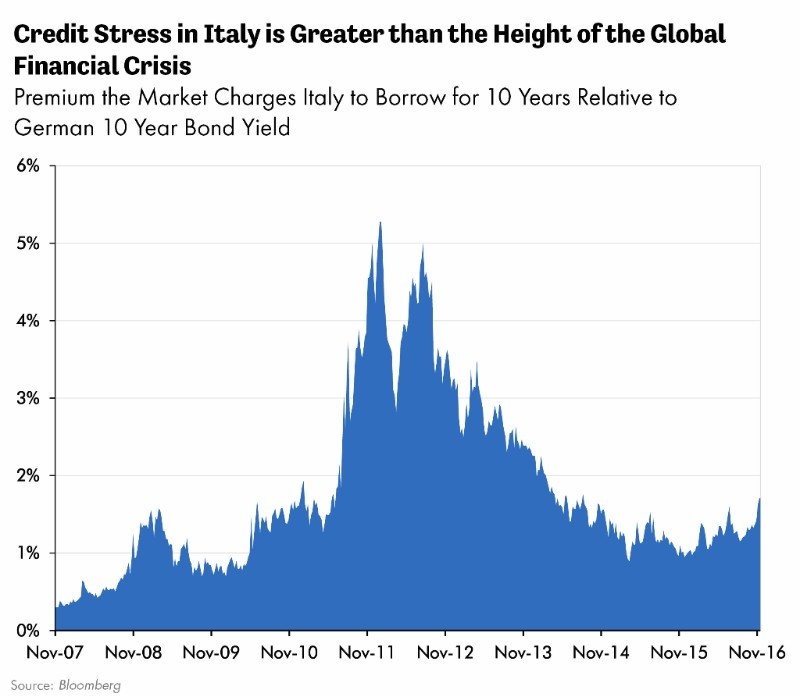

By Lewis Johnson - Chief Conclusion What does last week’s election mean for the markets? The election has been positive for the equity market but negative for bonds. Are bonds through? A veritable galaxy of investment[…]