By Lewis Johnson - CHIEF CONCLUSION In complex times, it’s important to focus. From where I sit, it seems that there are two big things going on in global markets right now. The first is a cyclical downturn of[…]

By Lewis Johnson - CHIEF CONCLUSION Buying an investment may be only half the battle. What about when to sell? We think the ability to sell well is one of the rarest and most valuable skills in investing. Our research[…]

By Lewis Johnson - CHIEF CONCLUSION The other day I passed a big milestone, I lost a hundred pounds from my peak weight. I thought I would take a minute and write about it, because like so many other things in life, I[…]

By Lewis Johnson - CHIEF CONCLUSION Are tariff announcements breaking the market’s “animal spirits” that are necessary for the health of a historically extended bull market in equities? We examine some important[…]

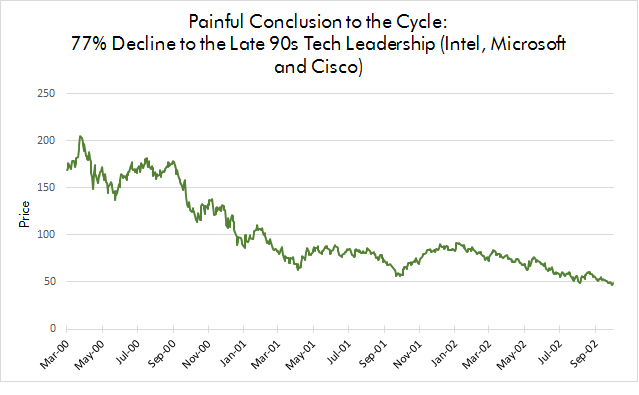

By Lewis Johnson - Chief Conclusion Today’s “Trends and Tail Risks” is about what happens to leadership stocks when confidence flees, and bull markets turn into bear markets, which has taken place on average every nine[…]