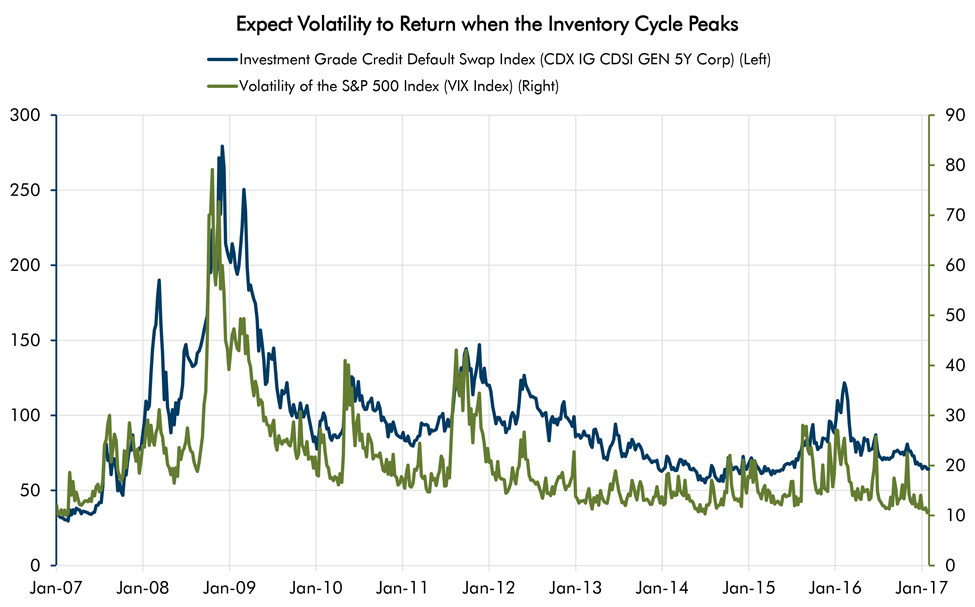

By Lewis Johnson - Chief Conclusion Clients will begin to see a thoughtful winnowing of our selected holdings in corporate bonds rated less than investment grade. The relentless search for yield has resulted in a[…]

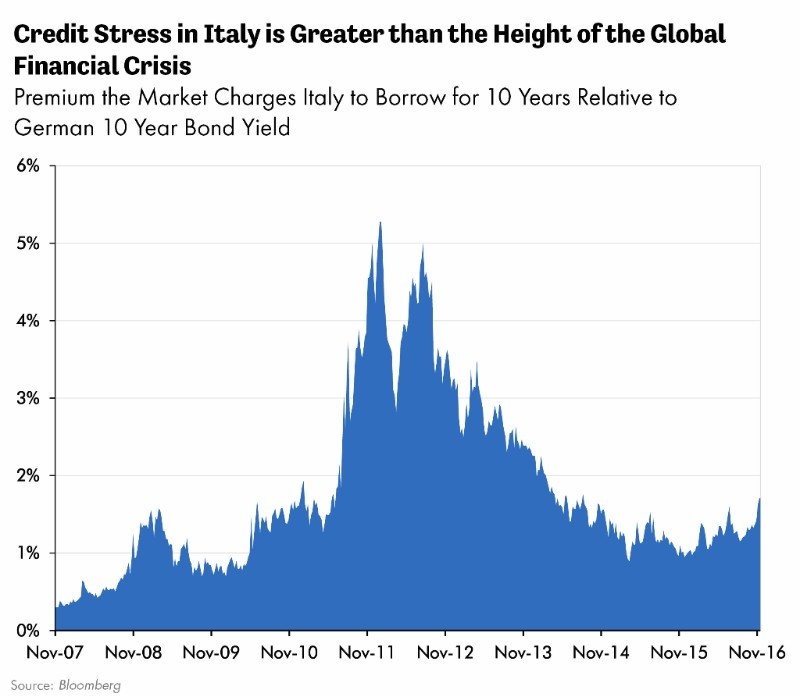

By Lewis Johnson - Chief Conclusion Evidence continues to accumulate globally that the secular bull market in bonds is alive and well. We discuss the most recent data that includes Europe’s first negative yielding[…]

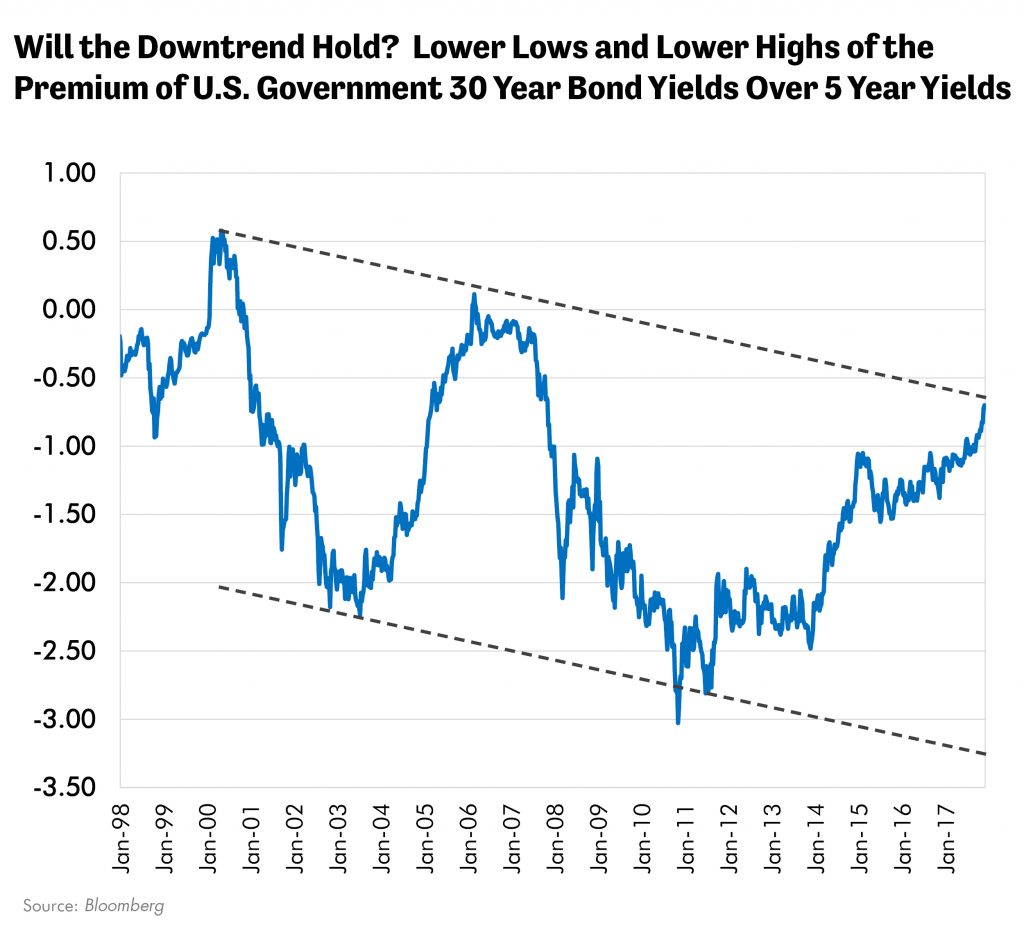

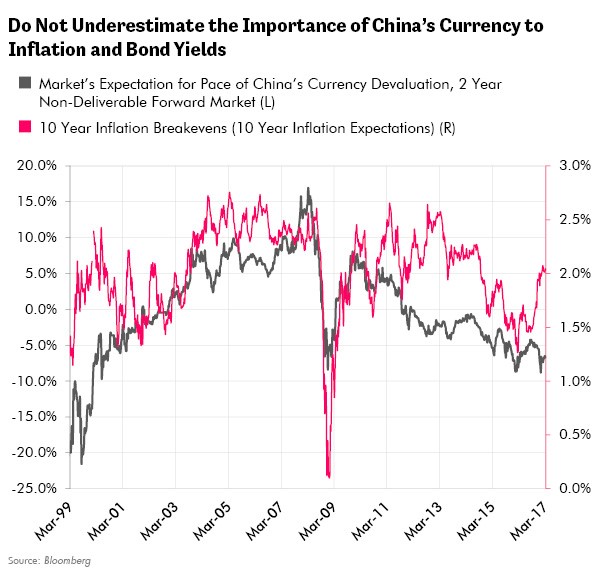

By Lewis Johnson - Chief Conclusion Investors underweighting the highest quality and longest duration bonds are ignoring the tail risks of deflationary shocks from China and Europe. Such positioning may disappoint[…]

By Lewis Johnson - Chief Conclusion Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern[…]

By Lewis Johnson - Chief Conclusion What does last week’s election mean for the markets? The election has been positive for the equity market but negative for bonds. Are bonds through? A veritable galaxy of investment[…]