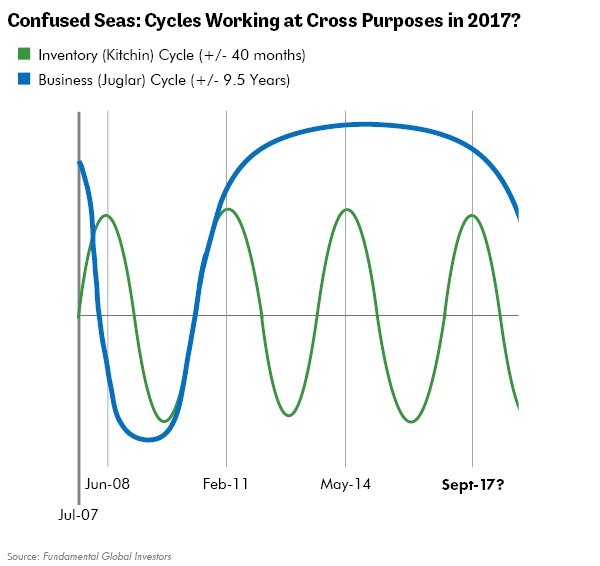

By Lewis Johnson - Chief Conclusion As next year progresses, investors may find the markets tossed by the confused seas of conflicting cycles: the upcycle of the 40 month inventory cycle and the looming downcycle of[…]

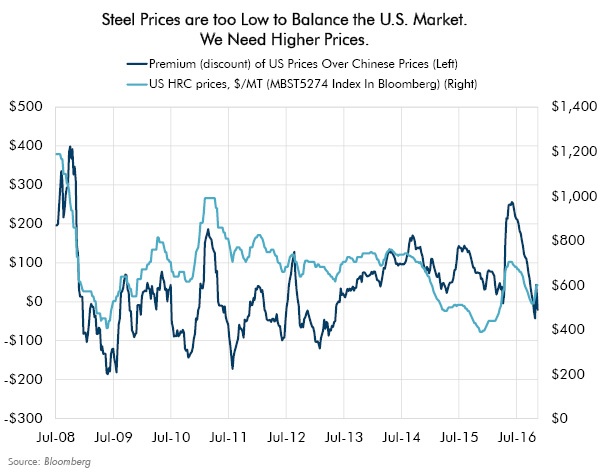

By Lewis Johnson - Chief Conclusion Our bearish outlook on the steel industry in mid-2014 helped us to avoid the huge declines in steel equities, some as high as 85%, that followed in the wake of the inventory cycle[…]

By Lewis Johnson - Chief Conclusion What does last week’s election mean for the markets? The election has been positive for the equity market but negative for bonds. Are bonds through? A veritable galaxy of investment[…]

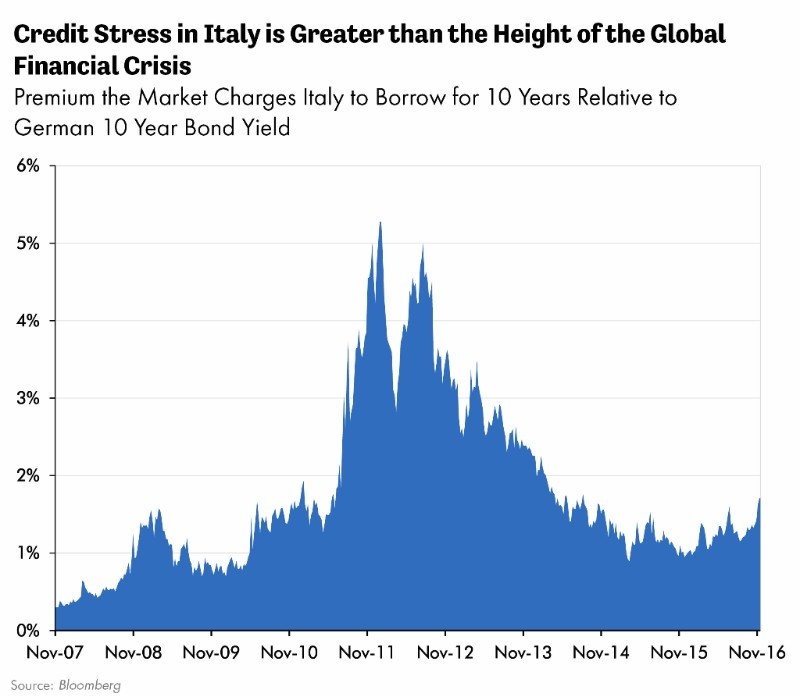

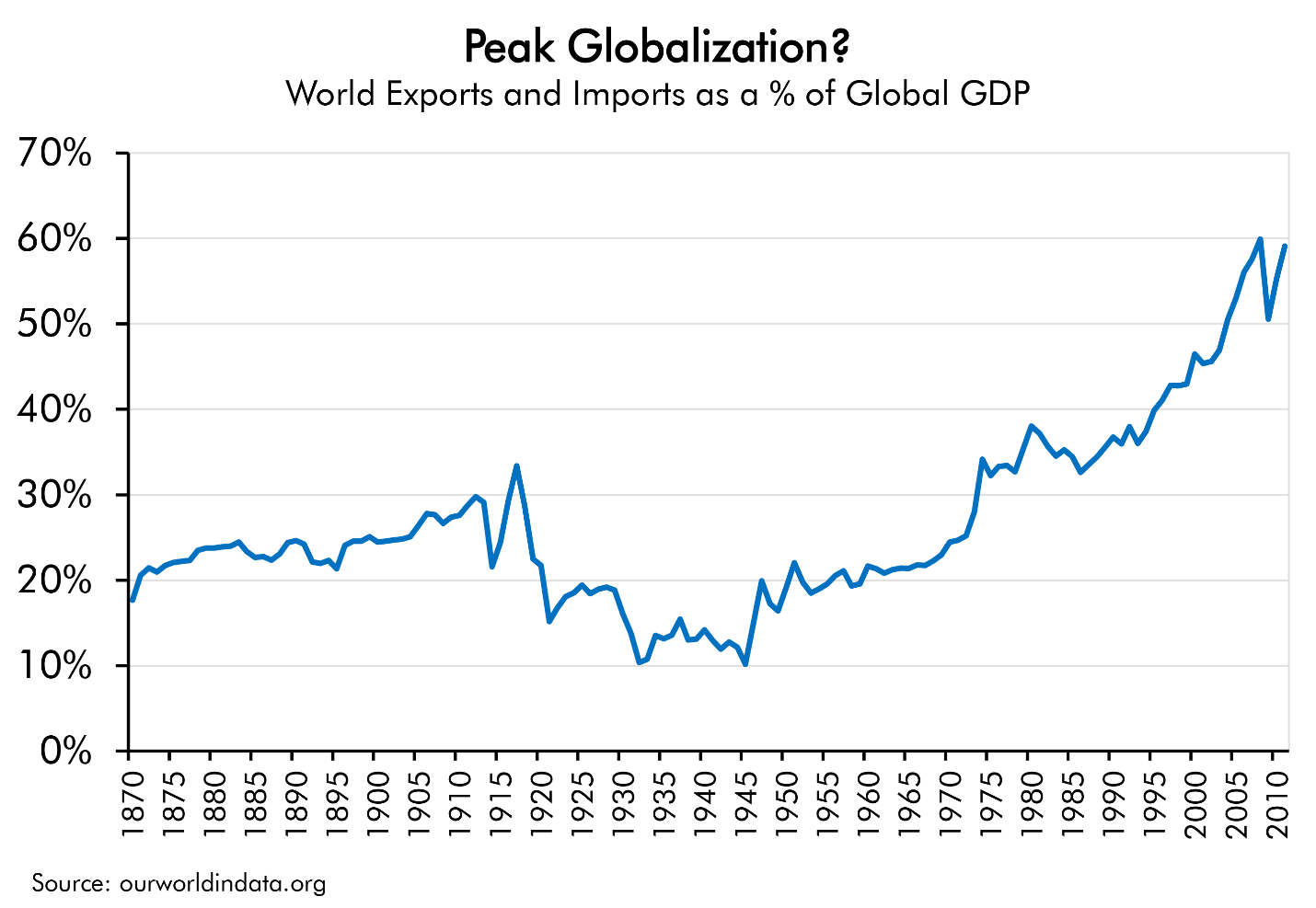

By Lewis Johnson - Chief Conclusion We expect that the upcoming Presidential election in the U.S. may add further evidence supporting the growth of a powerful and global bull market in populism and its corollary,[…]

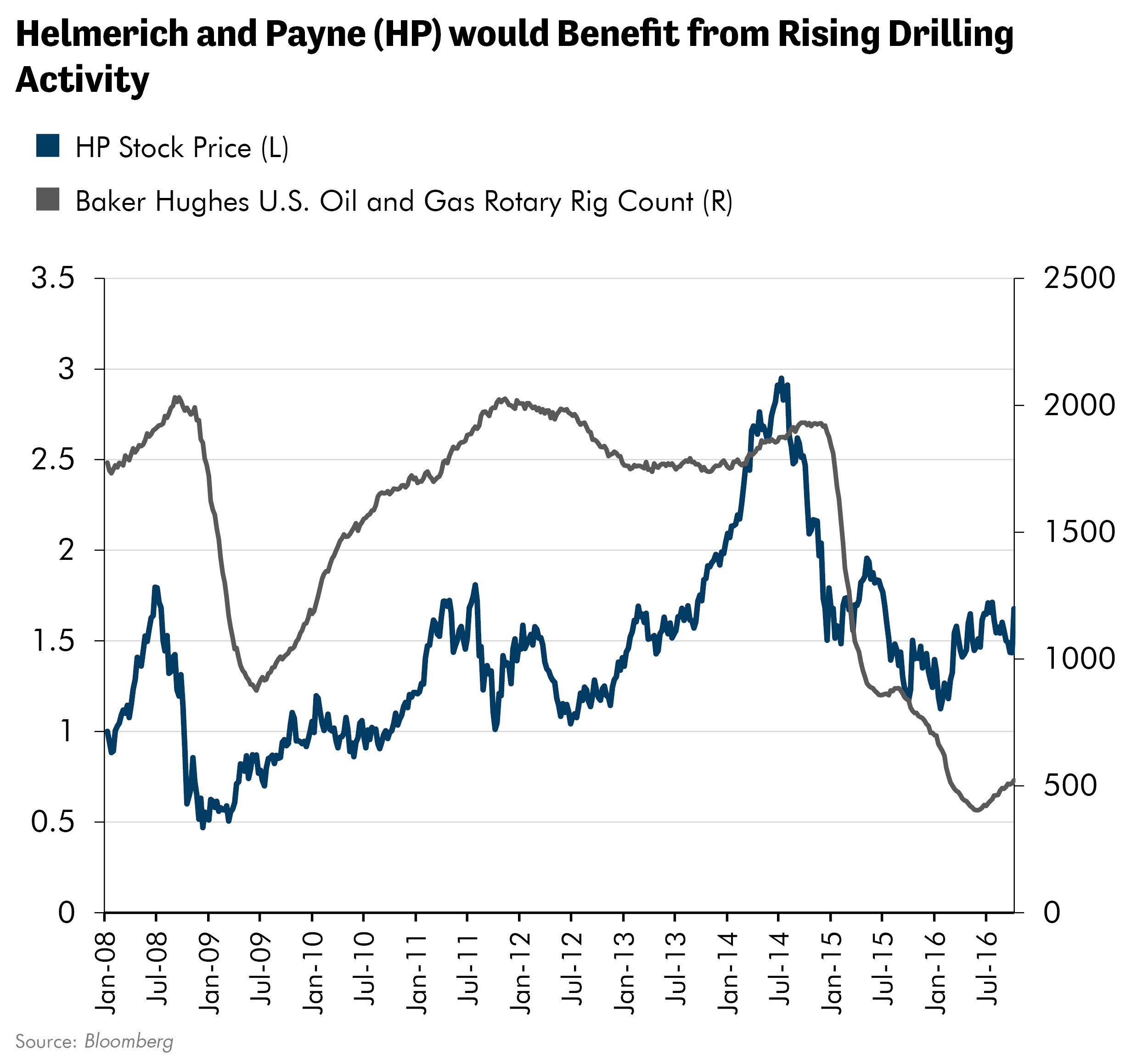

By Lewis Johnson - Chief Conclusion We continue to find value in the beaten-down oil industry. We believe that now is the time to make a targeted investment in the beleaguered oil service sector, where drilling[…]