By Lewis Johnson - CHIEF CONCLUSION The lightning fast 30% collapse in crude oil in recent days is a stark reminder of one market truism: markets go up the escalator and down the elevator. If your goal is to avoid[…]

By Lewis Johnson - CHIEF CONCLUSION "History doesn’t repeat but it does rhyme." - Mark Twain Financial markets look ahead. Wait for the news and you may fall behind the biggest moves. It appears we are now very deep[…]

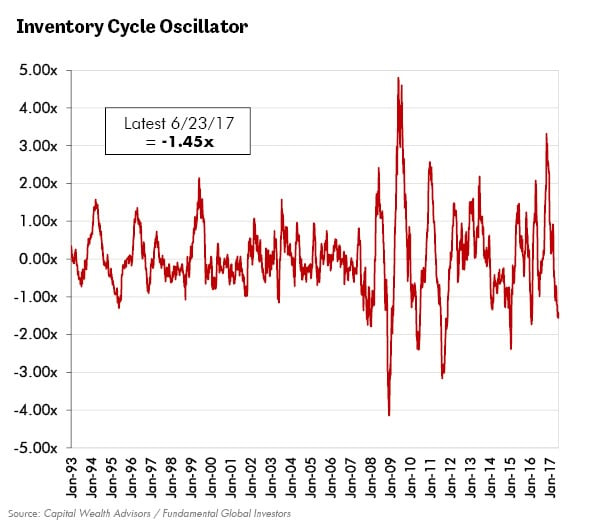

By Lewis Johnson - Chief Conclusion Cycles are always working in one direction or the other in the markets. How can investors avoid being victims of “unexpected” volatility, and better yet, even find a way to profit[…]

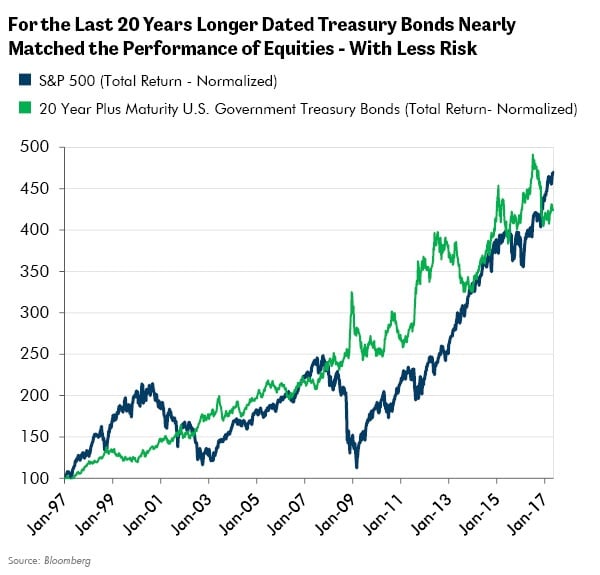

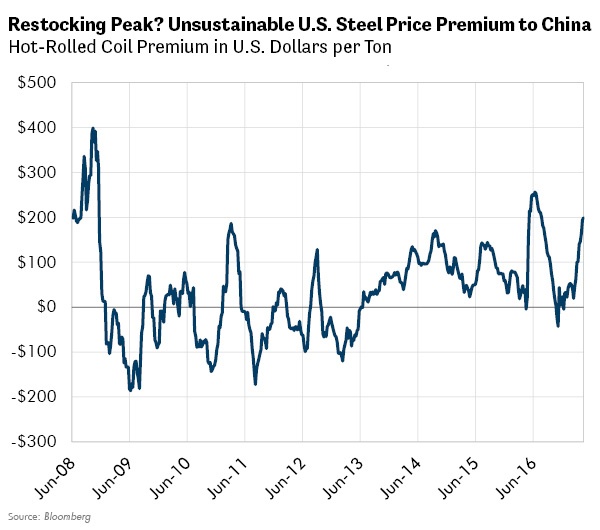

By Lewis Johnson - Chief Conclusion We noted two weeks ago that our trusted indicators in the steel markets had signaled that the inventory cycle was turning lower. We expect higher-quality, longer-dated bonds to[…]

By Lewis Johnson - Chief Conclusion Key leading indicators in the commodity markets support our expectation for a mid 2017 peak in the inventory cycle. Steel offers the best insight into this cycle and the slowdown[…]