By Lewis Johnson - CHIEF CONCLUSION Our goal is not to create “set it and forget it” portfolios but rather to proactively navigate a changing cycle. Because we do our own research in house, this means we are ready to[…]

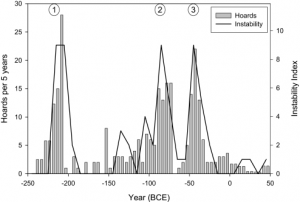

By Lewis Johnson - Chief Conclusion We believe that our prudent investors benefit from thoughtful research. Why? Because when markets become threatening a deep analytical toolbox gives investors more tools to manage[…]

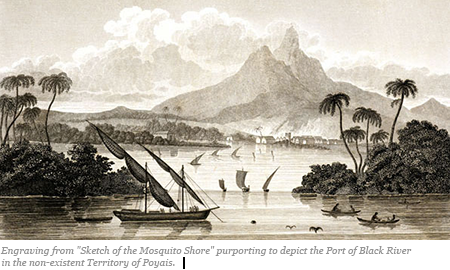

By Lewis Johnson - Chief Conclusion Prolonged market rallies act as a reinforcing mechanism to investors reaching for that extra yield without pausing to consider the risk associated with their actions. By no means is[…]

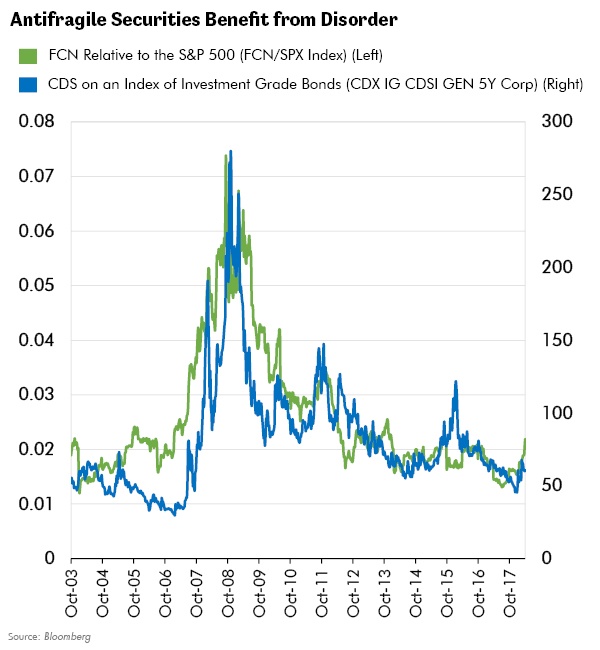

By Lewis Johnson - Chief Conclusion Rising political risks combined with worsening credit quality and central bank tightening are among the most important themes for investors to consider when making capital allocation[…]

By Lewis Johnson - Chief Conclusion Steel tariffs, and those on aluminum too, are much in the headlines. We maintain our long-held bullishness on the U.S. steel sector for reasons that have nothing to do with tariffs,[…]