By Lewis Johnson - Chief Conclusion Asking better questions is the fastest way to make more money in the markets. In today’s “Trends and Tail Risks,” I will take a step back and explain the backstory of how asking[…]

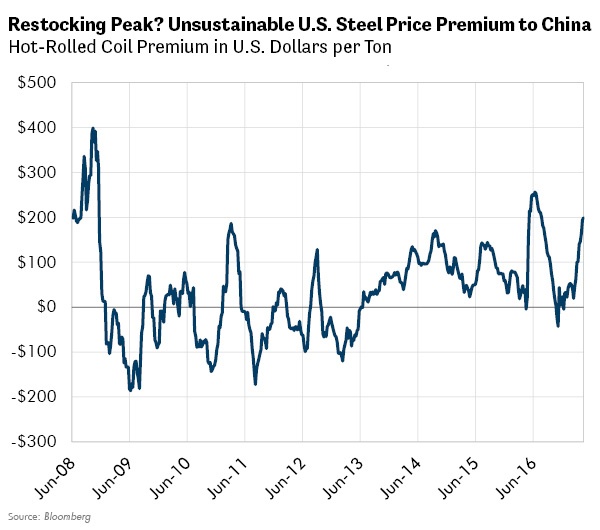

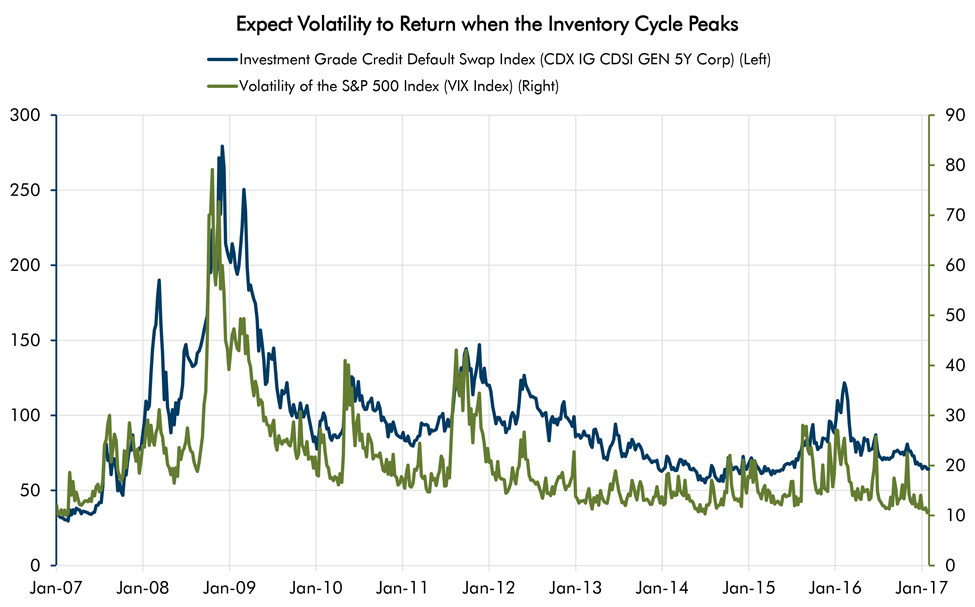

By Lewis Johnson - Chief Conclusion Key leading indicators in the commodity markets support our expectation for a mid 2017 peak in the inventory cycle. Steel offers the best insight into this cycle and the slowdown[…]

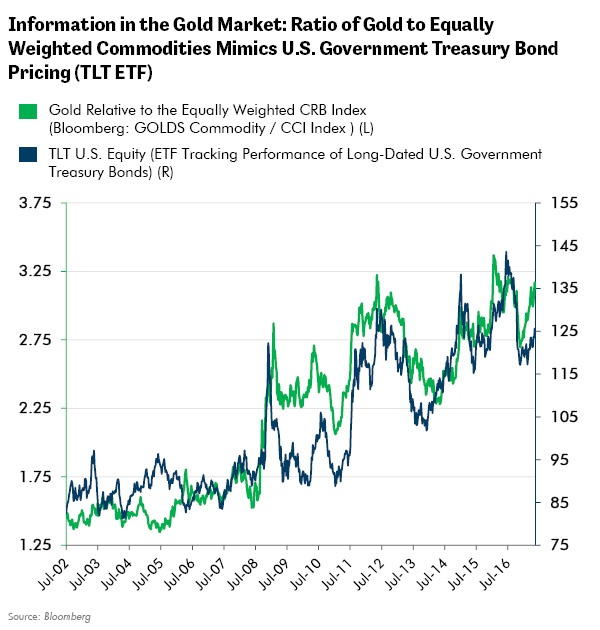

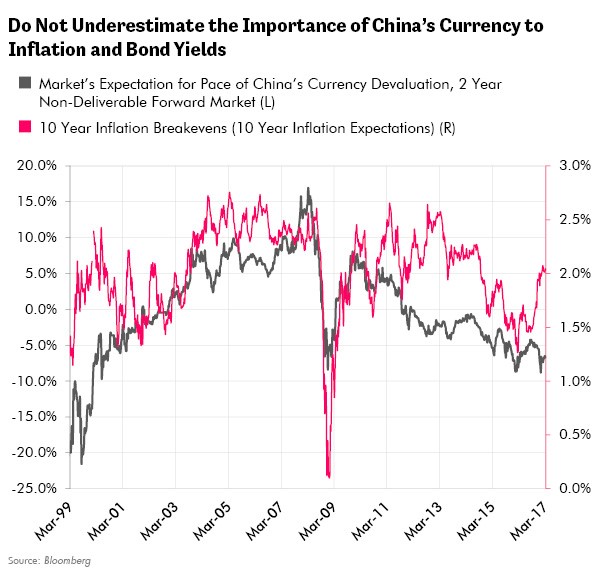

By Lewis Johnson - Chief Conclusion Investors underweighting the highest quality and longest duration bonds are ignoring the tail risks of deflationary shocks from China and Europe. Such positioning may disappoint[…]

By Lewis Johnson - Chief Conclusion Robotics and automation technology improvements are reaching a critical mass. These technological advances along with bias from government policies that favor capital over labor have[…]

By Lewis Johnson - Chief Conclusion Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern[…]