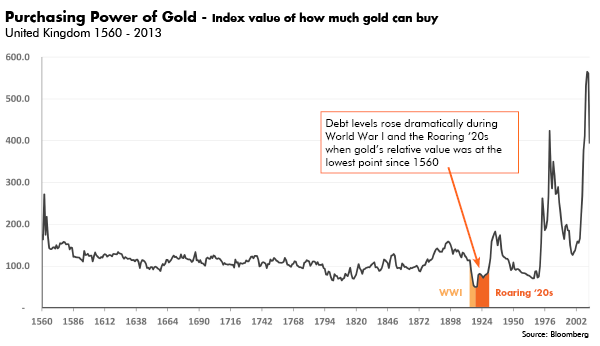

By Lewis Johnson - Chief Conclusion Notable outperformance by silver equities suggests we are just at the beginning of a new and extended precious metals upcycle. Overindebtedness is driving this bull market..

POSTED ON

June 17th

- POSTED IN

Prices Allocate Resources,

Cycles,

Indicators

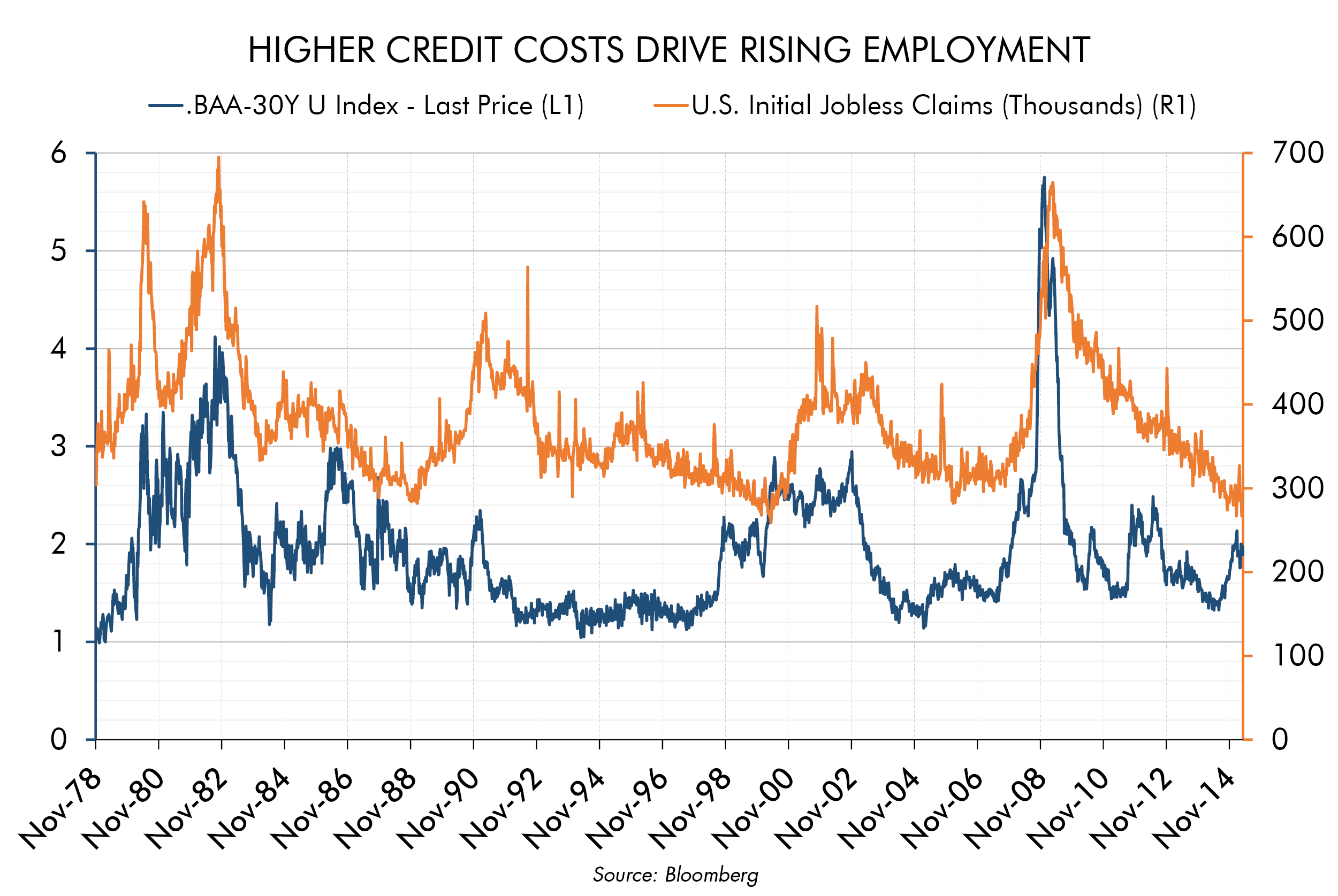

By Lewis Johnson - The rainy season is well underway here in sunny South Florida. Each day I can confidently predict that the weather will be hot and humid with a good chance of afternoon showers. I can even track by[…]

POSTED ON

April 22nd

- POSTED IN

Credit,

Indicators

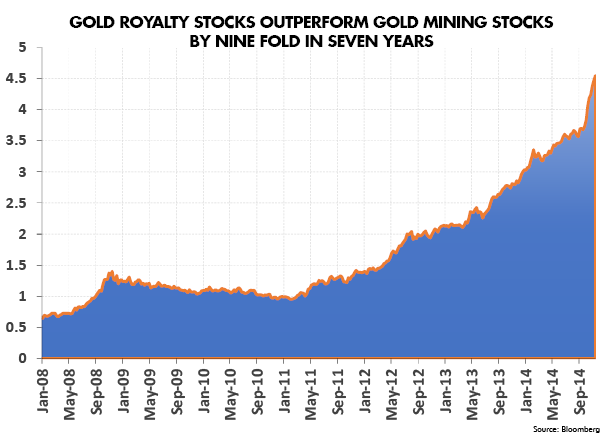

By Lewis Johnson - I have always been a very curious person. I can’t help but research and study some of the most paradoxical issues in the market. My goal is always a deeper understanding of how the financial world[…]

POSTED ON

November 19th

- POSTED IN

Portfolio Construction for a Challenging World,

Indicators,

Thinking About the Future

By Lewis Johnson - “Science advances one funeral at a time.”

POSTED ON

August 20th

- POSTED IN

Gold,

Indicators,

Relative Value of Gold (and Credit)

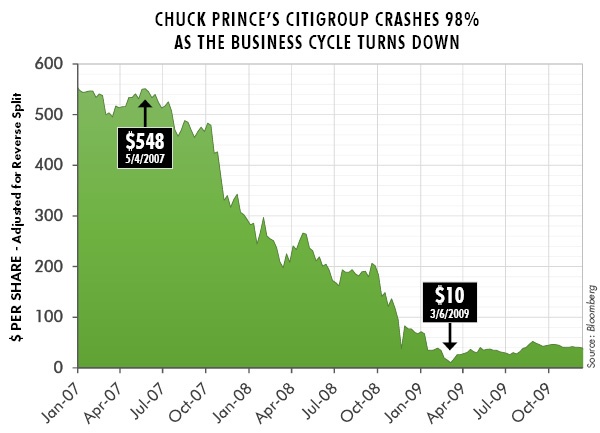

By Lewis Johnson - Last week’s Trends and Tail Risks noted that there is more money to be made being long the solution than there is in shorting the problem. We are convinced that over indebtedness is the world’s[…]