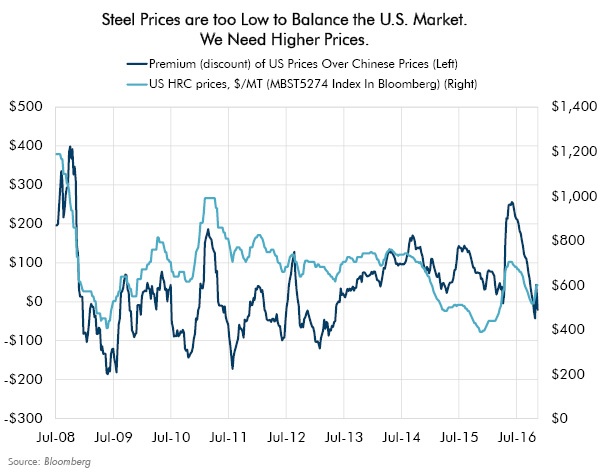

By Lewis Johnson - Chief Conclusion Our bearish outlook on the steel industry in mid-2014 helped us to avoid the huge declines in steel equities, some as high as 85%, that followed in the wake of the inventory cycle[…]

By Lewis Johnson - Chief Conclusion What does last week’s election mean for the markets? The election has been positive for the equity market but negative for bonds. Are bonds through? A veritable galaxy of investment[…]

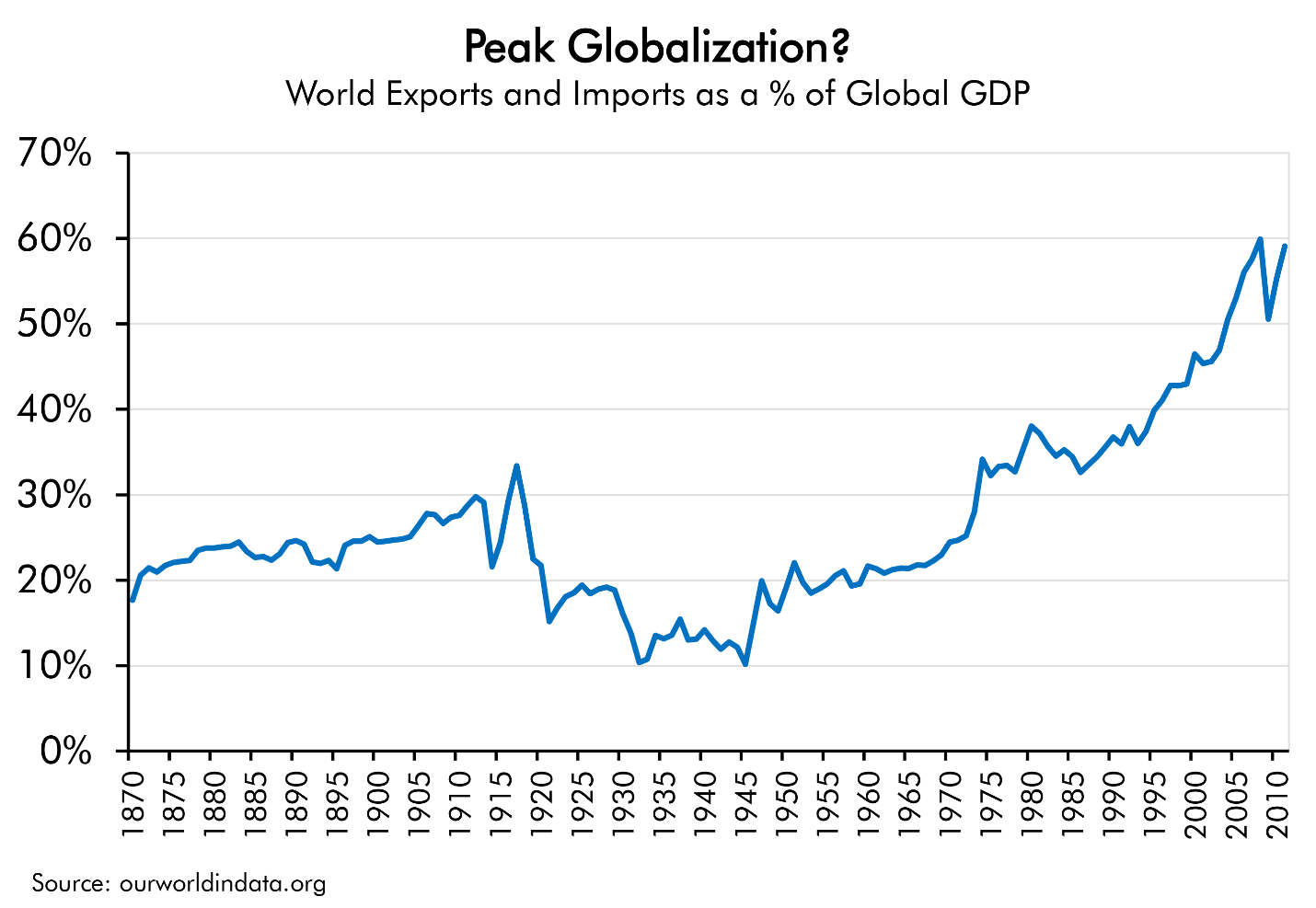

By Lewis Johnson - Chief Conclusion We expect that the upcoming Presidential election in the U.S. may add further evidence supporting the growth of a powerful and global bull market in populism and its corollary,[…]

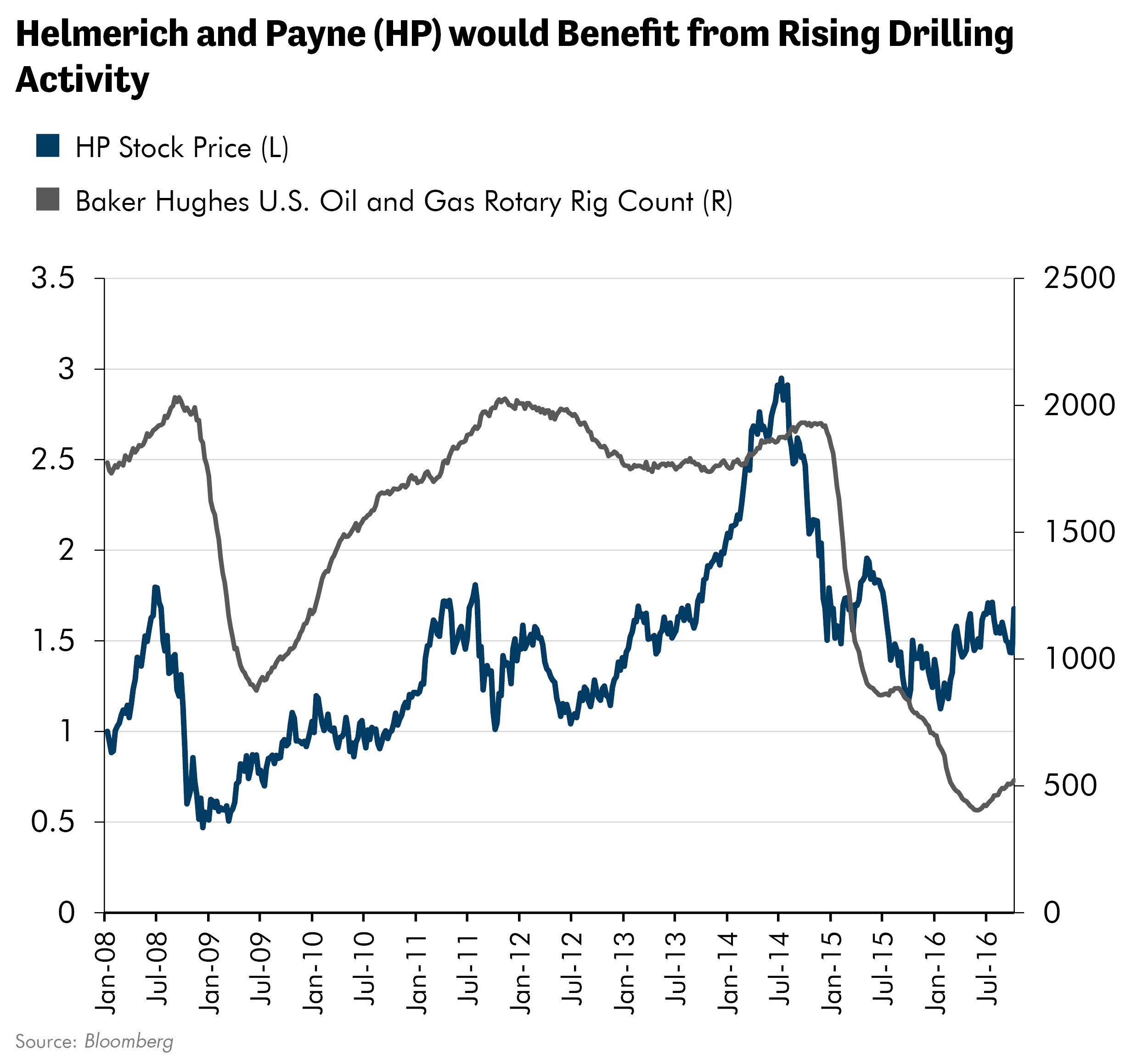

By Lewis Johnson - Chief Conclusion We continue to find value in the beaten-down oil industry. We believe that now is the time to make a targeted investment in the beleaguered oil service sector, where drilling[…]

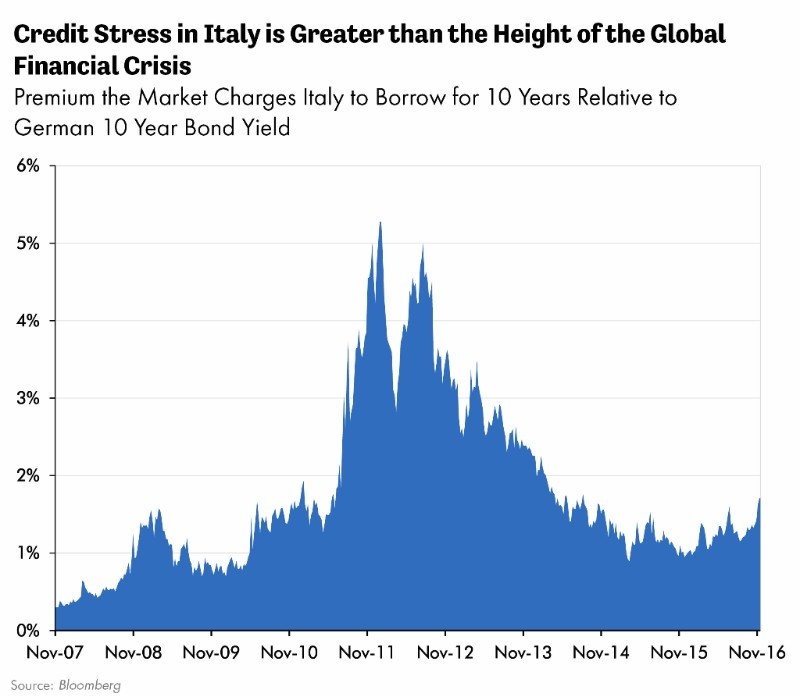

By Lewis Johnson - Chief Conclusion The 54% drop in the share price of Deutsche Bank (DB) in the last year raises questions about the health of our financial system. Shareholders at many other thinly capitalized[…]