By Lewis Johnson - Chief Conclusion Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern[…]

By Lewis Johnson - Chief Conclusion Today the Dow Jones Industrial Average hit 20,000. Yet we now find ourselves deep into the fourth longest expansion in recent history. For good reason, investors are asking if this[…]

By Lewis Johnson - Chief Conclusion The two most necessary preconditions for successful investing are 1.) insight and 2.) patience. One without the other will do you absolutely no good. Held patiently, a diversified[…]

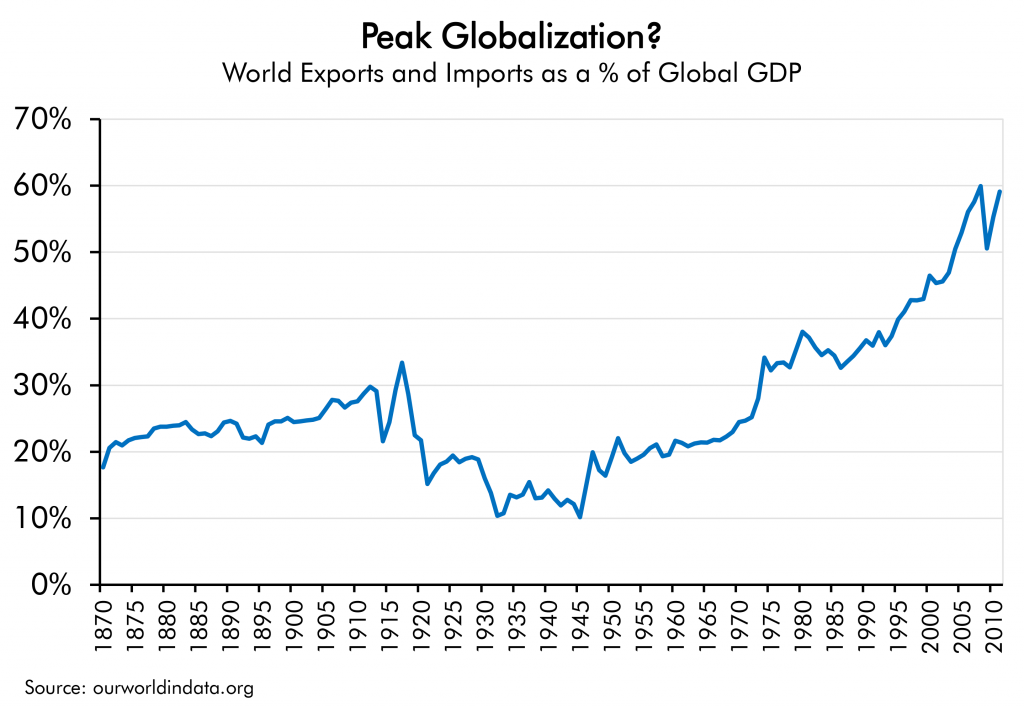

By Lewis Johnson - Chief Conclusion Do not underestimate the determination of the incoming Trump Administration to overturn the established norms of international trade. Don’t be surprised if, at the first opportunity,[…]

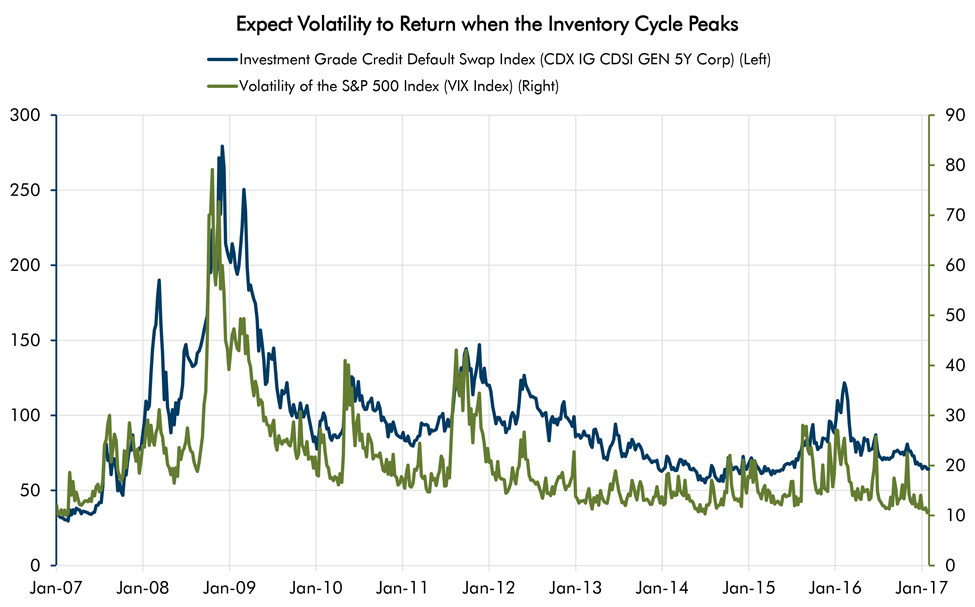

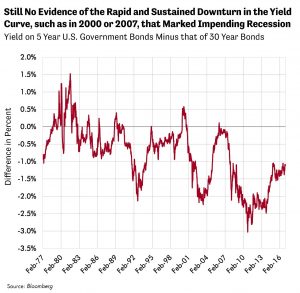

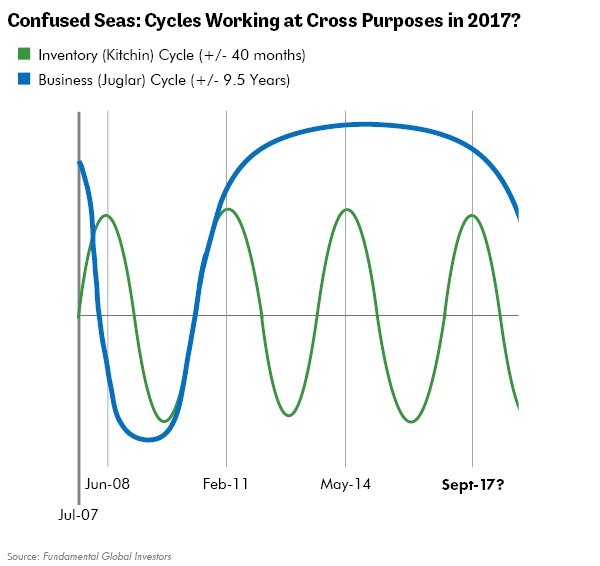

By Lewis Johnson - Chief Conclusion As next year progresses, investors may find the markets tossed by the confused seas of conflicting cycles: the upcycle of the 40 month inventory cycle and the looming downcycle of[…]