By Lewis Johnson - CHIEF CONCLUSION Ask anyone who has invested serious time analyzing the commodity markets and you will quickly come to understand the power of supply, demand, and prices to work in harmony to create[…]

By Lewis Johnson - CHIEF CONCLUSION The lightning fast 30% collapse in crude oil in recent days is a stark reminder of one market truism: markets go up the escalator and down the elevator. If your goal is to avoid[…]

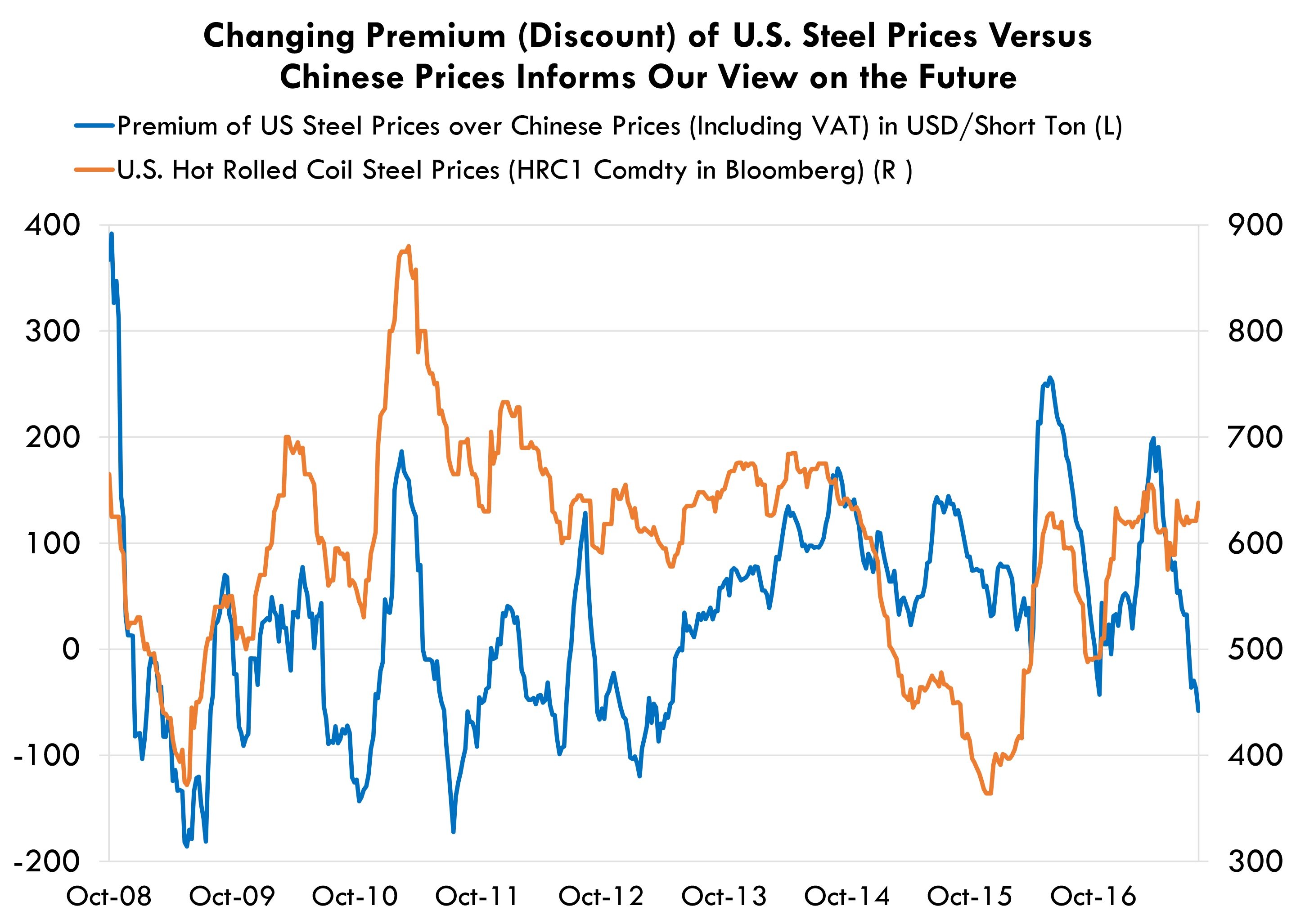

By Lewis Johnson - Chief Conclusion Steel tariffs, and those on aluminum too, are much in the headlines. We maintain our long-held bullishness on the U.S. steel sector for reasons that have nothing to do with tariffs,[…]

By Lewis Johnson - Chief Conclusion We believe that in the coming months we may see rising steel prices in the U.S. The power of arbitrage, one of the strongest forces in the markets, is now set up to make this happen.[…]

By Lewis Johnson - Chief Conclusion Robotics and automation technology improvements are reaching a critical mass. These technological advances along with bias from government policies that favor capital over labor have[…]