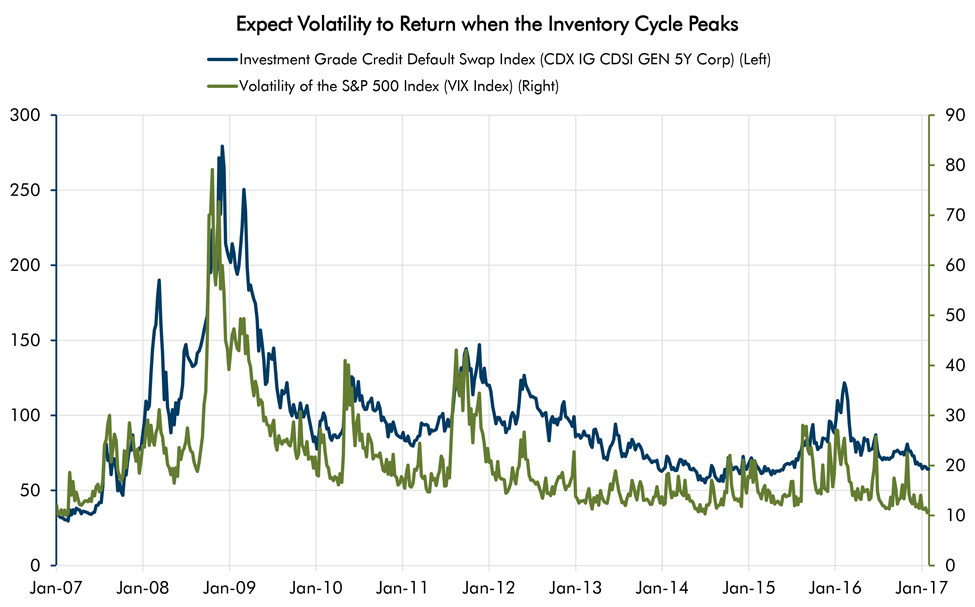

By Lewis Johnson - Chief Conclusion The most pressing problem that we attempt to solve for our clients is how to grow their hard-won savings thoughtfully. Money only grows when it takes risk – but what risks to take?[…]

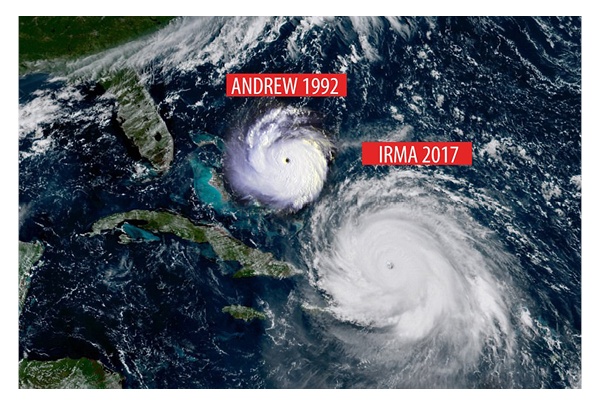

By Lewis Johnson - Chief Conclusion Hurricane Irma gave all of us in southwest Florida a real world example of the limits of prediction. In life as in the financial markets, we believe it’s better to beat the rush and[…]

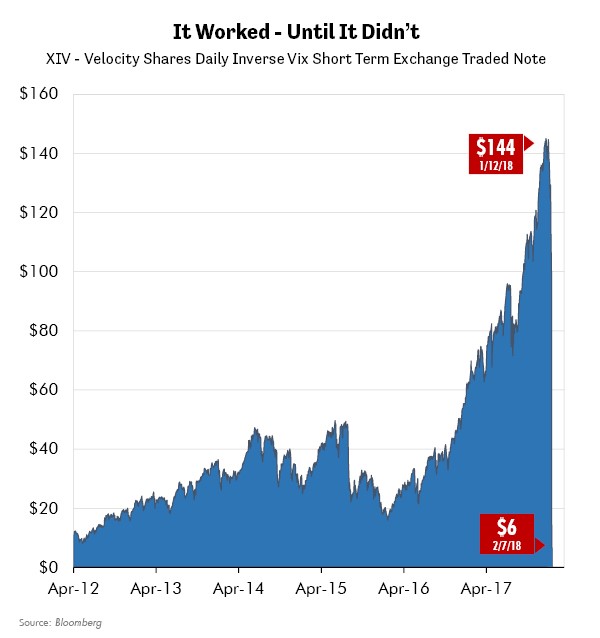

By Lewis Johnson - Chief Conclusion The discipline of discomfort demands that investors who seek to outperform must make hard choices, choices that don’t come naturally. This often means cultivating controversy in your[…]

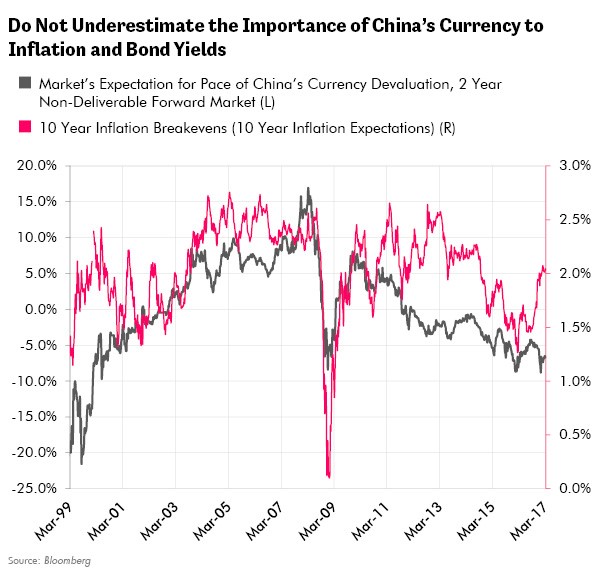

By Lewis Johnson - Chief Conclusion Investors underweighting the highest quality and longest duration bonds are ignoring the tail risks of deflationary shocks from China and Europe. Such positioning may disappoint[…]

By Lewis Johnson - Chief Conclusion Populism’s explosive growth is likely sowing the seeds for dramatic change in the markets. Every day we see evidence of this in the news and in the markets. My own belief and concern[…]